Joint Ownership

Updated: January 10, 2023

Joint ownership is a way to make it easier for individuals to enter the property market by sharing the purchase. Joint property is any property or asset owned by two or more people. Examples: you and your spouse, your business partners, or other people you want to own property or assets with.

Joint ownership is a way to make it easier for individuals to enter the property market by sharing the purchase. Joint property is any property or asset owned by two or more people. Examples: you and your spouse, your business partners, or other people you want to own property or assets with.

Although one of many estate planning options, joint ownership laws can play a significant role in determining the distribution of assets during divorce proceedings.

Professional assistance is required when setting up joint ownership since there is considerable state-to-state variability and frequent legal changes when it comes to joint ownership, including which is the default type for that state, what types are allowed, what assets are allowed to be jointly owned, the definition of joint ownership, and which relationships are recognized.

Although originally created for real estate, any property such as motor vehicles and financial accounts can have shared ownership. Legally, joint ownership takes precedence over all other types of property claims, such as trusts, payable on death accounts, and transfer on death deeds, and probate court rulings from wills or intestate rulings.

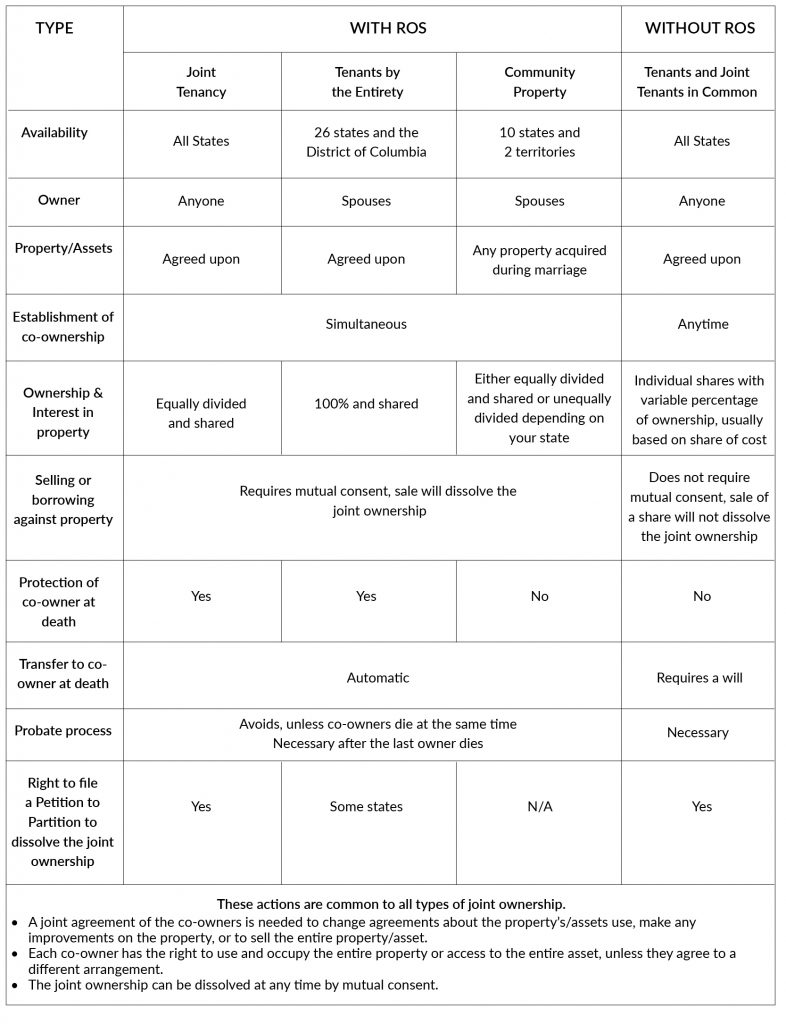

- Joint ownership with rights of survivorship allows the title or deed to pass automatically to the surviving owner if/when you die.

- In joint ownership without rights of survivorship your assets don’t pass automatically to the surviving partner but are distributed as outlined in your will.

- Joint ownership requires a written contract or other valid documentation specifying each person’s simultaneous ownership of the property.

- Joint ownership of motor vehicles, boats, and other items can be confirmed using the title document.

- Financial accounts (banks, brokerage accounts, etc.) can be set up in the same way.

- Owners are not taxed separately.

- Joint ownership persists until an owner dies or all owners agree to terminate it.

Since joint owners have equal rights in the property any, some problems can arise.

- Any change in your relationship can complicate the process.

- If you have marital problems or a falling out with a co-owner, neither can sell the jointly owned property without consent from the other.

- The equal rights will still allow access to the assets, which can be a major problem if the relationship becomes hostile.

- Even if you have a good relationship, it is possible to be taken advantage of. For example:

- If your child is a joint owner of your bank account, they can withdraw money without your permission; and/or

- If you add another owner to avoid probate or for convenience, you have given away half of your property which can then be sold, mortgaged, or lost due to debt without involving you.

Comparing Joint Ownership With and Without Rights of Survivorship (ROS)

An A-B or ABC trust is also a form of joint ownership, but is discussed in a different section.

Joint Ownership with The Right of Survivorship

With Joint Ownership With The Right of Survivorship (JTWROS) owners share equal ownership, control of, and responsibility for the property/assets, including expenses/debts, such as mortgage payments, maintenance, and property taxes. Although these powers and responsibilities could be total if the other co-owner does not hold up their end of the ownership, both owners must agree if the assets are to be sold.

The rights of survivorship also stipulates equal shares of the property/assets, including income earned from the property/assets, despite what each owner contributed to the property/asset. Colorado, Connecticut, Ohio, and Vermont are exceptions.

There are certain requirements in order to assure that the rights of survivorship exists.

- The joint owners must acquire the asset at the same time.

- A written contract or other valid documentation between two or more people specifying each person’s simultaneous ownership of the same real or personal property.

- If property is not properly titled, you need to execute and record a new deed/title that states the survivorship intention. The deed or title to the property will name all owners as joint tenants.

- The Joint Tenancy, Community Property, or Tenants by the Entirety document needs to be carefully worded to be legal and official so a legal professional is necessary, especially since this may vary among states.

While the joint ownership exists the ability to sell or transfer interest in the asset depends on the type of joint ownership. If there is no clear documentation that survivorship rights were intended, it will be assumed that a tenancy in common exists and ownership will not pass to the surviving owner, the deceased owner’s share is inherited by their heirs instead.

While joint ownership may be appropriate for the protection of some property, your estate plan should include other ways of safeguarding your assets. There are different types of joint ownership.

After your death the assets automatically transfer to your spouse or other co-owner(s) without the need for a will.

- Even if you intended to transfer these assets to your beneficiaries in your will or a trust, the tenants by the entirety supersedes/takes precedence and the assets will go directly to the joint owner.

- The surviving owner must fill out documentation showing the title now belongs to them.

- They will need a Death Certificate. You can order them yourself from the vital statistics office in the state where the death occurred, the local Department of Health office, or from the city hall or other local records office.

- The documents are then submitted to a bank, state motor vehicles department, county real estate records office, county, or other regional title agency.

Joint Tenancy

Joint Tenancy is available in all states. With joint tenancy the level of ownership and share in the profits, costs, and/or debt depends on the number of owners, such as 50% each if there are two owners or 25% each for four joint owners. It is the default property ownership for married couples in some states.

Unlike other forms with rights of survivorship, joint tenancy is not restricted to spouses, although it is usually used by spouses, parents, and children.

It can be used with a wide variety of assets, including any asset with deeds/title documents (real estate, motor vehicles, boats), financial accounts, stock, securities and annuities, businesses, and brokerage accounts.

You can create joint tenancy with either property/assets you purchase/acquire together or individual property/assets you want to add a co-owner to. The second choice may:

- Result in gift taxes, if not your spouse; and

- Appear like you are creating joint tenancy for the express purpose of avoiding probate, so you will need to be careful when doing this.

For a Joint Tenancy to be valid:

For a Joint Tenancy to be valid:

- Each tenant must each have equal ownership and control of the property/assets — Unity of Possession;

- Each tenant’s interest in the property/assets is equal — Unity of Interest;

- All tenants need to receive title to the property/assets via the same deed/title/document — Unity of Title; and

- Ownership of the property/assets must be taken by all tenants simultaneously — Unity of Time.

Joint tenancy can prevent debts or lawsuit settlements incurred by an individual owner from being collected by creditors from the jointly owned property/assets. Only that person’s sole property is at risk.

A few situations make joint property available to creditors.

- Unpaid federal taxes on the property/assets and debts incurred jointly allow creditors to place a lien on the property and claim payment, even if it means selling it.

- If one of the owners dies, creditors may be able to make claims against the deceased owner’s previously owned assets.

While you may not sell your shares of the property/assets without the consent of all other tenants, you can transfer them to another person. This will terminate the joint tenancy agreement and force the new co-tenant and the remaining co-tenant(s) to enter a tenancy or joint tenancy in common. Other ways to end a joint tenancy include:

- An agreement by all tenants to convert to a tenancy in common, in which case each tenant can determine what to do with their share; or

- Seeking judicial partition if an agreement can’t be made. There are two kinds of partition, both involve the courts and are typically done with property.

- A Partition in kind — a decision by the court about how to equally split up the property between co-tenants.

- A Partition by sale — if the court is unable to equitably split up the property it will force the sale of the property and each co-tenant receives their share of the profits.

Tenants by the Entirety

Tenants by the Entirety (TBE) has similar rules as Joint Tenancy but only applies to married couples, who are treated as a single legal entity.

Tenants by the Entirety (TBE) has similar rules as Joint Tenancy but only applies to married couples, who are treated as a single legal entity.

- TBE may be the default property ownership for married couples in some states.

- TBE better protects the jointly owned property/assets from debts or lawsuit settlements incurred by an individual owner from being collected by the creditors of just one spouse than joint tenancy, but is also not fool-proof. Properties/assets are not protected from creditors for debts shared by both spouses.

For a TBE deed to be valid:

- Spouses must each have 100% ownership, not 50% each as it would be with joint tenancy, and control of the premises/assets — Unity of Possession;

- Each spouse’s interest in the property/assets is equal — Unity of Interest;

- Both spouses need to receive ownership to the property/assets via the same deed/title/document — Unity of Title;

- Ownership of the property/assets must be taken by both spouses simultaneously — Unity of Time; and

- In most states, tenants must be married at the time they acquire the property/assets and remain married to each other throughout the period of ownership — Unity of Marriage.

Twenty-five states and the District of Columbia recognize TBE as of 2021. States can vary in the type of property they allow to be claimed.

- Alaska, Indiana, Kentucky, Michigan, New York, North Carolina, Oregon, and Rhode Island only allow TBE for ownership of real estate.

- Illinois only allows TBE for ownership of homestead property.

- Arkansas, Delaware, Florida, Hawaii, Maryland, Massachusetts, Mississippi, Missouri, New Jersey, Oklahoma, Pennsylvania, Tennessee, The District of Columbia, Vermont, Virginia, and Wyoming allow TBE for ownership of financial assets and all property types.

- In Michigan, unmarried partners with joint tenancy will have it automatically converted to TBE if they subsequently marry.

- Ohio only recognizes tenancy by the entirety for deeds issued before April 4, 1985.

- Some states allow domestic partners to have tenants by the entirety.

Even if you have marital issues, neither spouse can sell your jointly owned assets without consent from the other.

- This will be true even if you divorce, when the right of survivorship will no longer apply.

- This and other issues can make the ownership of the property difficult to resolve, especially if there is ongoing conflict and emotional stress.

While neither you nor your spouse may sell or transfer your shares of the property/assets without the consent of the other, a TBE can be terminated/voided at any time by divorce or mutual consent of the spouses. In both cases the agreement becomes a tenancy in common where the right of survivorship no longer applies and each spouse may sell their share in the property/assets. Alternately, spouses can agree to convey title to the property/assets to a third party by gift or deed.

Community Property

Community property is a form of joint property/asset ownership where every property and any income/asset acquired by one or both spouses during marriage is considered jointly owned even if both spouses’ names are not on the deed or title.

Community property is a form of joint property/asset ownership where every property and any income/asset acquired by one or both spouses during marriage is considered jointly owned even if both spouses’ names are not on the deed or title.

- Community property ownership is allowed for married couples who live or own property in Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, or Wisconsin.

- Community property is also allowed in U.S. territories Guam and Puerto Rico.

- California, Nevada and Washington also allow community property ownership for domestic partners.

- Most states consider the assets to be equally shared, while in a few.

- In Alaska the community property system is optional and spouses may agree to hold some or all marital property in common by creating a community property trust or community property agreement.

- The states of Florida, Kentucky, Tennessee, and South Dakota have similar systems.

- Puerto Rico and several Native American jurisdictions also allow property to be held as community property.

- Assets that are not considered community property include:

- Property acquired before marriage or during legal separation;

- Anything given to only one of the spouses as a gift or through inheritance;

- Property in only one spouse’s name that will never be used to benefit the other;

- Contributions to IRAs, 401(k)s and similar employer-sponsored retirement plans made before the marriage;

- Property acquired during a previous marriage that may be excluded for the protection of children from a former spouse;

- Any assets excluded by a prenuptial agreement; and

- Any assets bought with money earned in a non-community property state. For example, if you live in a tenants by the entirety state and buy property in a community property state, the property ownership follows tenants by the entirety laws.; and

- In some states these assets can become community property if the couple creates a marital or community property agreement.

- Unlike Joint Property and Tenants by the Entirety, both spouses share most debts acquired by either of them during marriage.

- In other words, creditors are entitled to collect debts from the joint property whether they are owed by both or either of the owners.

- However, few states allow debts and liabilities to be kept separately.

- If it is agreed to by both parties.

- In Texas a judge may opt to divide assets in a way that they deem equitable to both spouses.

- Assets may be divided unequally if:

- You or your spouse misappropriated community property at any time before your divorce is finalized;

- One spouse has committed a tort liability that did not involve the other spouse – only the involved spouse’s share can be used to pay damages;

- You or your spouse receives a personal injury settlement – those amounts would go to the spouse who received them;

- You or your spouse has educational debt; which is kept separate after the divorce; and

- Your jointly held debts exceed your assets – the assets and liabilities are divided in a way that’s designed to protect the interests of your creditors.

- One spouse dies;

- The couple move to a state with tenants by the entirety laws;

- The couple divorces; and/or

- The couple separate (Washington and California)

Pros and Cons

There are both benefits and drawbacks to these types of joint ownership and it is important to know both before going with any joint ownership option.

Benefits

The major benefit is that joint ownership settles the right of property ownership automatically and avoids the problems created by the probate process when the first owner dies.

- Property/assets can go directly to the co-owner, even if you don’t have a will, and avoid the months or even years this process can take.

- The property/asset would be subject to probate after your surviving spouse dies if no other estate planning steps, such as a trust, were in place or if you both die simultaneously in a common event

Except for the eight states that only allow Tenants by the Entirety for ownership of real estate, Joint Ownership With The Right of Survivorship can be used for most property, including motor vehicles, real estate, bank accounts, and stocks.

Joint tenancy and tenancy by the entirement are easier to create than trusts and wills.

Since it is jointly owned, creditors can’t go after the property if only one owner has debt or declares bankruptcy. Some states will even protect the survivor from the deceased owner’s creditors.

Joint ownership laws can make determining the distribution of assets during divorce proceedings much easier.

Drawbacks

Since both co-owners have access to the properties/assets, one owner may be able to take advantage of the other, especially if they are having cognitive decline as they age.

Because both tenants must agree on any sale of property/assets, discord among owners can complicate these sales.

If one owner becomes incapacitated, the other owner(s) can’t make any decisions on the incapacitated owner’s share of the property/assets. Joint decisions would still be required for selling or transferring the property/assets, since both owners are still alive, even if one of the owners is unable to. This would prevent the unaffected owner from selling or transferring the property/asset, unless planned for ahead of time.

If one owner becomes incapacitated, the other owner(s) can’t make any decisions on the incapacitated owner’s share of the property/assets. Joint decisions would still be required for selling or transferring the property/assets, since both owners are still alive, even if one of the owners is unable to. This would prevent the unaffected owner from selling or transferring the property/asset, unless planned for ahead of time.

- If each joint owner appoints a Durable Power of Attorney, someone they trust will be given authority to manage their affairs, this can be avoided.

- A document can be prepared ahead of time to have the property/assets transferred to a living trust managed by the uncompromised owner if this occurs.

Either co-owner will be completely responsible for expenses if the other co-owner does not pay their share.

Joint tenancy gives the survivor sole rights to the property/assets, which can also be a problem if not done carefully.

- The co-owner can claim that they are entitled as the surviving joint tenant to all of the shared assets, even those without a deed or title. This can be fine if that was your intention.

- If you were hoping to pass the value of the property/asset to your designated heirs, there is no legal obligation for the surviving owner to honor that request since joint ownership takes precedence over all other methods of transferring estate assets.

Although joint ownership can avoid the probate process, it does not reduce estate taxes for non-spousal co-owners like an irrevocable trust would.

It may interfere with a large tax break when your surviving spouse dies if:

- You want to add your spouse as a joint tenant on your separately owned property/assets instead of leaving it to them in an irrevocable trust;

- Your property’s/asset’s value has gone up (or you expect it to); and/or

- You don’t live in a community property state.

Probate court would become involved:

- If both/all of you die at the same time without a will or trust accounting for the assets to determine which of the owner’s closest relatives the property/assets would go to under state law; and/or

- When your spouse or last tenant dies or passes on the property/asset. They would need another method to av

In some states, if one owner dies leaving a single owner, creditors can then seek to collect debts from the remaining owner.

The Right of Survivorship can be forfeited if a judge deems that someone was made a joint tenant with the intent of avoiding probate, so it is best to only create one if the property/asset is acquired together. This also prevents you giving away half of any interest in your individual property/assets.

Joint Ownership without The Rights of Survivorship

Joint Ownership without Rights of Survivorship includes Tenancy in Common and Joint Tenants in Common. Both types allow people to equally or unequally share ownership of property/financial assets while permitting them to stipulate in their will who will inherit their share after their death and will be subject to the probate process. The major difference is the assets that are jointly owned, property vs any asset.

Tenancy in Common

Tenancy in common is an arrangement in which two or more people, whether or not they are related to each other, share ownership interests in a property. The property may be commercial or residential. The laws vary from state to state.

Tenancy in common only applies to property. It may be the default property ownership for married couples in some states.

Like other joint ownerships, you and your co-tenant in common:

- Have equal access to use and occupy the property, unless you otherwise agree upon a different schedule;

- Share control of and responsibility for the property, including all expenses and taxes, not just their percentage; and

- Have responsibility for any unpaid expenses or taxes owed by the other, even if the assets are unevenly divided.

There are four major differences from joint ownership with the right of survivorship.

- Ownership does not have to be equal, each tenant can own a different share or financial percentage of the property if agreed to, usually the percentage of the property’s cost paid by that individual.

- Ownership of the property does not automatically go to your surviving co-owner(s) upon your death, your share goes to your estate and then to any heirs or person you designate in your will or a trust.

- You can independently sell, transfer, or borrow against your portion of ownership without the consent of the other co-owner(s).

- You may transfer or split your share and/or add another tenant at any time throughout the life of the arrangement without consulting the other owner(s).

Like other types of joint ownership, there are drawbacks to be aware of.

- Since these shares are considered your individual property, the transfer to your heirs is done with your will and therefore must go through the probate process.

- Since most lenders require that mortgage documents are signed by all the parties who hold title, all tenants are equally liable for all property costs, taxes, and debts.

- If one owner cannot pay their bills or owes money for other reasons, the remaining owner(s) have to make any payments to avoid any liens on the property or even foreclosure.

- If the remaining owners do not make these payments, the lender may seize the holdings from any or all of the owners.

- This is not true if only one party was allowed to take out the loan.

- Since any owner can add a tenant without consulting the others, you may find yourself owning the property with someone you do not know, trust, or want.

- Any owner can force the division or sale of property by filing a partition action.

Ways to dissolve a Tenancy in Common

Ways to dissolve a Tenancy in Common

The most common way is for one or more co-tenants to buy-out the other owners.

If co-tenants cannot agree on plans for the property, a partition action can be taken which dissolves the tenancy in common by dividing it among the owners.

- A partition in kind is the most direct way to divide the property and does not involve the probate process.

- Ideally this will be voluntary, but it can be court-ordered if the co-tenants can’t come to an agreement.

- If the court is involved, a judge will divide the property among the owners who will then individually own their share. It is usually the method used when co-tenants are antagonistic.

- A partition of the property by sale may be necessary if the co-owners refuse to cooperate. This involves selling the property and dividing the proceeds according to each co-owner’s interest in the property.

Joint Tenants in Common

Joint tenants in common is similar to tenants in common, but also includes other types of property and financial assets such as bank accounts, brokerage accounts, investment portfolios, or annuities. There are a few minor differences.

- Each tenant’s share of the asset and income or debt is equal to their contribution to it.

- Each tenant has equal access to use and occupy a property and to withdraw from any financial assets/accounts.

- A partition action is not necessary for financial assets since the percent ownership is already established.

- Burris R. Joint Tenancy: Definition, Pros And Cons. Rocket Mortgage website. Updated: November 22, 2022. Accessed: January 10, 2023..

- Chen J. Joint Tenancy. Investopedia website. Updated: November 16, 2021. Accessed: January 10, 2023.

- Chen J. Joint Tenants in Common (JTIC) Definition. Investopedia website. Updated: March 21, 2021. Accessed: January 10, 2023.

- Chen J. What Are Joint Tenants With Right of Survivorship (JTWROS)?. Investopedia website. Updated: March 28, 2022. Accessed: January 10, 2023.

- Chen J. Tenants by Entirety (TBE). Investopedia website. Updated: March 6, 2021. Accessed: January 10, 2023.

- Chen J. What Is Tenancy by the Entirety? Requirements and Rights. Investopedia website. Updated: March 28, 2022. Accessed: January 10, 2023.

- Chen J. Tenancy in Common. Investopedia website. Updated: July 29, 2022. Accessed: January 10, 2023.

- Chism P. Tenancy in Common, Explained. Rocket Mortgage website. Updated: August 23, 2022. Accessed: January 10, 2023.

- Colestock S. Tenancy by the Entirety: Definition & Explanation. smartasset website. Updated October 18, 2021. Accessed: January 10, 2023.

- Garber J. Property Titles: Tenants by the Entirety. The balance website. Updated: November 10, 2021. Accessed: January 10, 2023..

- Kagan J. Joint Owned Property: Definition, How It Works, Risks. Investopedia website. Updated: March 14, 2021. Accessed: January 10, 2023.

- Kenton W. Community Property Meaning, and When and Where It Applies. Investopedia website. Updated: October 1, 2022. Accessed: January 10, 2023.

- Lake R. What Are the Community Property States? smartasset website. Updated December 6, 2022. Accessed: January 10, 2023.

- Nowacki L. Tenancy By Entirety: Defined And Explained. Rocket Mortgage website. Updated November 24, 2022. Accessed: January 10, 2023.

- Parker T. Community Property State: What It Is, How It Works, State List. Investopedia website. Updated: June 21, 2022. Accessed: January 10, 2023.

- Peeler T. Terminating a Joint Tenancy | Joint Tenants Pros and Cons. LegalMatch website. Updated: August 26, 2021. Accessed: January 10, 2023.

- Randolph M. Avoiding Probate With Joint Tenancy. Nolo website. Accessed: January 10, 2023.

- Randolph M. Avoiding Probate With Tenancy by the Entirety Ownership. Nolo website. Accessed: January 10, 2023.

- Starbuck Gerson E. What Is a Community Property State and How Does it Impact Finances? Experian website. Posted: April 27, 2022. Accessed: January 10, 2023.

- Tenancy by the Entirety States vs. Joint Tenants & Community Property. Asset Protection Planners website. Accessed: January 10, 2023.

- Weintraub E. Is Joint Tenancy Your Best Title Option? thebalance website. Updated: November 19, 2021. Accessed: January 11, 2022.

- Weintraub E. What Is Tenancy in Common? thebalance website. Updated: January 22, 2022. Accessed: January 10, 2023.