Financial Power of Attorney

Updated: January 16, 2023

At some point people with a chronic disease or terminal illness may become incapable of making or unwilling to make important decisions about their finances, estate, and/or business and may need a reliable person to take over long-term or permanently. This also can be useful for short-term situations, such as major surgery or a temporary impairment of mental status.

At some point people with a chronic disease or terminal illness may become incapable of making or unwilling to make important decisions about their finances, estate, and/or business and may need a reliable person to take over long-term or permanently. This also can be useful for short-term situations, such as major surgery or a temporary impairment of mental status.

It is advisable to have a power of attorney (POA) even if most of your assets are in a revocable living trust that has named a back-up or successor trustee in case this happens. Anyone 18 years old or older can create a POA.

Financial POA is an important part of estate planning. It is a document that allows you, the principal, to give legal authority to at least one other person, usually a spouse, adult child, or other close relative, to act for you on behalf of your estate. Multiple agents can be chosen, but they must be able to work smoothly together to prevent major conflicts, including scheduling conflicts, that can delay decisions.

This person is typically referred to as your agent or “attorney-in-fact” and can act independently, even without consulting an attorney. Financial POA can either be durable or limited based on the purpose of the particular circumstances.

POA is granted using a legal document that must be notarized and should be presented to any party your agent is dealing with. The power is limited to the actions listed in the document, which may be further limited by state-specific laws. Many states have an official financial power of attorney form to assist with this.

While most parties accept a POA, it is not required by law. To increase the chance of a POA being accepted your attorney-in-fact needs to always bring a certified copy of the POA document with them along with a recognized form of identification and any other corroborating documents, such as a medical provider’s confirmation of disability.

You should regularly review and revise the power of attorney document when circumstances or preferences change, such as moving, changes in your estate that require different actions, a divorce, or death of an agent.

If you do not plan ahead the courts will become involved and you may be unable to manage your estate and have a say in who is chosen as guardians, conservators, or committees to manage your estate.

Types of Power of Attorney

Power of attorney (POA) is not a single entity but a flexible tool to accommodate a variety of situations. In many cases you may be sharing decision making with your agent, especially if you are only physically unable to perform financial or legal responsibilities.

The terms used for a POA can be confusing since they are called types of POAs. Basically each POA has four characteristics that determine the purpose of the POA and contribute to the name of the POA; duration, area of authority, scope of authority, and when it begins.

- Duration — You can either give temporary (limited) or permanent (durable) authority to any specific agent to act on your behalf.

TYPE

AREA OF AUTHORITY

DURATION

FUNCTION

Limited POA

Usually only specific tasks that you designate

When task is done, POA expires. May or may not resume if you become incapacitated again.

To act on your behalf for any indicated tasks, usually financial or estate related, while you are unable to perform them due to health or availability

Durable POA

General, financial, legal, care issues, or health care

Until revoked or your death

To act on your behalf for any indicated tasks if you become unable to for a prolonged period or permanently.

- Area of Authority — The POA can give the agent authority over one of two areas.

- Financial or legal POA gives your agent authority to make important decisions about your finances and estate. Unless otherwise specified, financial POA is considered durable in some states,

- Healthcare POA/Proxy, discussed in another section, gives your agent authority to make medical decisions for you.

- Powers/Function — The POA may be limited or general.

- A Limited/Special POA restricts your agent to specific powers, such as paying your bills, the sale of your home, applying for government benefits, or filing taxes.

- A General POA gives broader rights to manage your assets and/or business and act on your behalf in legal matters.

- Time of Onset – You can have the POA take effect immediately or only if a specific situation arises.

- If the POA takes effect immediately, both you and your agent or attorney-in-fact can make financial or legal decisions until such time as you become unwilling or unable to make them.

- A Springing POA could take effect only if a specific situation arises, when you will not be present to handle a specific situation or transaction — for whatever reason, such as you become mentally incompetent, physically disabled, unconscious, or otherwise incapacitated due to illness or injury, or are otherwise unable to act for yourself.

- You may require that a healthcare provider certifies your medical condition. You may even designate a specific provider to determine your competency, or even require that two licensed physicians agree on your mental or physical state. Time of Onset — You can have the POA take effect immediately or only if a specific situation arises.

Traditionally Power of Attorney will be in effect until any of the following:

Traditionally Power of Attorney will be in effect until any of the following:

- You specifically cancel or revoke it, see Changing or Revoking a Power of Attorney;

- It reaches its expiration date, if it has one;

- Your death;

- A court invalidates it;

- You divorce your spouse who is the agent;

- The agent can no longer perform the outlined actions, for whatever reason; and/or

- You become mentally competent or physically able to resume responsibility (special POA only and only in some states).

Choosing an Agent

- This protection makes it easier for people to accept the responsibilities of being an agent, but it may not be enough to prevent them from using the powers for their own gain.

- To try and minimize this, if unable to review updates yourself, add a provision to have these updates reviewed by a designated third party.

- If anyone suspects an agent of wrongdoing, report the actions to a law enforcement agency and consult a lawyer.

- Although it is not crucial, it’s better to choose the most qualified and responsible person.

- Ask them how they will will have adequate time, be able to advocate fully for you, deal with difficult disputes, and handle all the duties you will assign to them; which will be presented in the next section.

- You may want to avoid choosing someone who is too busy, not motivated enough, or will be too grief-stricken if something happens to you to handle the responsibilities of being your attorney in fact.

- If you will be sharing decision making with your agent, choose someone you work well with and will defer to you when there is disagreement and you are still capable of responsible decisions.

- It is important to choose an agent able to keep accurate records of all actions done on your behalf and to give you periodic updates to keep you informed.

- Family and friends chosen as agents are not usually compensated for their time.

- You can request that your agents act jointly in making decisions or have different powers and act separately.

- When working jointly, co-agents can:

- Ensure more sound decisions, acting as checks and balances against one another;

- Potentially delay important transactions or signings of legal documents when schedules don’t line up; and/or

- Make things difficult when agents disagree, so it is important to make plans for times when co-agents might disagree.

- You may want to name a back-up, if the primary agent is unavailable, or a successor.

- Your agent should receive a copy of the power of attorney document.

Choosing Powers to Assign Your Agent

Many of the powers you could give to your agent are regulated by and differ from state to state. If you have assets in different states, make sure that state allows agents to perform those actions.

Many of the powers you could give to your agent are regulated by and differ from state to state. If you have assets in different states, make sure that state allows agents to perform those actions.

Remember that, whatever actions you want your agent to do, they must be spelled out in detail in the document. Some may need to be authorized by the state. For example, some states allow your agent to make gifts legally, while in other states the agent needs to have it explicitly authorized in their power of attorney document.

Common powers or actions include any or all of these.

Financial and legal matters

- Access to all of your accounts, such as brokerage accounts, bank accounts, annuities, 401(k)s/IRAs/403(b)s, and government benefits, credit card information, and user names/passwords to all sites

- Making legal decisions about the estate and day-to-day finances, including:

- Handling financial and business transactions, including investments;

- Operating business interests;

- Signing checks for depositing in the bank;

- Signing checks or otherwise using your funds to pay bills, including everyday expenses and mortgage, tax, utility bills, insurance bills, phone, cable, and internet bills;

- Cancelling any services and subscriptions you do not need

- Buying, selling and managing real estate;

- Borrowing money as needed to maintain the estate;

- Filing tax returns; and/or

- Employing professional help.

- Creating or revising trusts for you, transferring your assets to existing trusts, buying life insurance, and settling claims.

- Handling matters involving your beneficiaries.

- Entering into contracts, dealing with real and personal property.

- Making gifts on your behalf, using gift tax and estate tax guidelines or specific instructions that you specify.

- Resolving creditor and other claims on the estate, and lawsuits against the estate.

- Monitoring your state-of-mind in order to intervene before a financial crisis happens.

- Protecting against scams or people preying on a person with a terminal illness.

- Sharing access to safety deposit boxes.

Seeing to the upkeep of your residence.

Making medical decisions. However a separate Healthcare POA or Proxy is better for this. A POA that includes both financial and healthcare provisions will have your personal medical and financial information, however if you would like to use professionals, it would not be appropriate for the broker to have your medical information any more than your medical professionals need to know your financial status.

Actions by the agent need to be signed in a specific way, usually either of:

Actions by the agent need to be signed in a specific way, usually either of:

- Your Name, by your agent under Power of Attorney; or

- Your Agent, attorney-in-fact for Your Name.

Actions that can’t be performed include:

- Changing or revoking your will or creating one for you; however they can alter how your assets are distributed by changing the ownership (title) to them;

- Changing or transferring POA to another agent;

- Commingling/combining their property or other assets with yours;

- Performing any other fiduciary duties that are not in your best interest;

- Voting in your place;

- Any actions not permitted in your state;

- Anything not specifically listed in the document; and

- Any decisions after your death, unless they are also your executor and/or trustee.

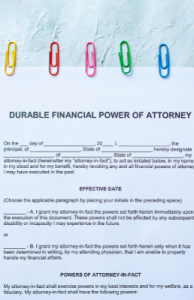

Creating a Power of Attorney

- General form – LawDepot website

- State-specific and type-specific forms

- Your full name and social security number (SSN).

- The attorney-in-fact (your agent) full name including their address and telephone number (preferably their cell phone).

- The state the POA will be valid in.

- The specific actions you want your agent to take.

- The duration of the POA, including events that will revoke it.

- Your signature, which usually needs to be notarized, and in front of the number of witnesses required in your state.

Changing or Revoking a Power of Attorney

- You can revoke your POA at any time, as long as you are mentally competent.

- All changes and revocations should be in writing and a copy sent to your agent.

- If the goal is to discontinue POD a Power of Attorney Revocation Form can be used. Any document must clearly state your desire to revoke your previous POA and include:

- The principal’s name;

- The attorney-in-fact name;

- The date the POA took effect;

- The date the POA is revoked; and

- A notary public seal of certification (only required in certain states)

- If the goal is to change the agent or terms of the POA you can either revoke your current one and fill out a new Power of Attorney form, or just make a new POA document, which will supersede your previous one. All POA documents should be signed by you in front of a notary public, and given to your agent and any third parties they have been in contact with (e.g. your bank).

- If you recorded your POA at your county recorder’s office, you should record the revocation in the same place.

- You should inform all other interested parties such as your spouse, other family, lawyer, and accountant and provide them with copies of the documents.

- Power of Attorney Revocation Forms – eforms, LawDepot

These are some common reasons for changing agents or powers or revoking the POA.

These are some common reasons for changing agents or powers or revoking the POA.

- You no longer need one, such as your health improves to the point you can assume responsibility.

- Your relationship with your agent has changed, such as a divorce or you have less trust in them due to other changes.

- The agent dies, although you could avoid having to do this by naming a back-up or alternate agent in the original document.

- You want to alter the powers granted to the agent due to changes in your estate and/or add another agent to divide responsibilities.

- Your current agent is no longer competent or willing to fulfill their duties.

- You are competent and willing – This is the simplest situation and you can easily revoke your current POA and make a new document as outlined above.

- You are competent but unwilling – This may be a difficult situation, but the only option may be your children convincing you. If they can’t, but your attorney and accountant agree with them, they may be able to if they can provide concrete reasons why.

- You are incompetent and the current POA agent is willing – If the current power of attorney is agreeable, they can “sign-over” their rights and your children can create a new POA document for you.

- You are incompetent and current POA agent is unwilling

- This is the most difficult situation and will likely require a lawyer and other professionals to change your POA.

- It is usually expensive and requires a lot of time, some of it in court. This can be stressful on family relationships.

Resources

- Help for agents under a power of attorney. Consumerfinance.gov. Published: May 2019.

- What Caregivers Should Know About Managing a Loved One’s Money. AARP website. Published: January 30, 2021.

- A Guide to Power of Attorney for Elderly Parents. Caring.com website. Updated: July 16, 2021. Accessed: January 16, 2023.

- Durable Financial Power of Attorney. FindLaw website. Updated: May 4, 2022. Accessed: November 28, 2022.

- Haman E. What Is a Durable Power of Attorney? LegalZoom website. Updated: July 13, 2021. Accessed: January 14, 2022.

- Haskins J. Financial Power of Attorney: How It Works. LegalZoom website. Updated: October 24, 2022. Accessed: January 16, 2023.

- Haskins J. 5 Reasons to Revoke a Power of Attorney. LegalZoom website. Updated: May 2, 2022. Accessed: January 16, 2023.

- Hayes A. Financial Power of Attorney Definition. Investopedia website. Updated: August 16, 2020. Accessed: January 16, 2023.

- Irving S. Durable Financial Power of Attorney: How It Works. NOLO website. Accessed: January 16, 2023.

- Kagan J. Power of Attorney. Investopedia website. Updated: July 24, 2022. Accessed: January 16, 2023.

- Kunjukunju S. Understanding Powers of Attorney to Protect Seniors. American Bankers Association website. Posted: November 4, 2020. Accessed: January 16, 2023.

- Power of Attorney for an Older Adult’s Financial Matters. FindLaw website. Updated: December 8, 2022. Accessed: January 16, 2023.

- Revocation of Power of Attorney. LawDepot website. Updated: September 6, 2022. Accessed: January 14, 2022.

- Roth A. 6 Steps to Protect Your Money From Cognitive Decline. AARP website. Published: July 21, 2021. Accessed: January 16, 2023.

- Salas J. Who Needs a Financial Power of Attorney? LegalZoom website. Updated: May 2, 2022. Accessed: January 16, 2023.

- Walrack J. What Is Financial Power of Attorney? thebalance website. Updated: July 18, 2022. Accessed: January 16, 2023.

- What Is a Power of Attorney (POA)? LegalZoom website. Updated: January 6, 2023. Accessed: January 16, 2023.