Trusts

Updated: December 22, 2022

A trust is another way to leave your estate to your beneficiaries. A trust is a fiduciary (financial) relationship in which you, as the trustmaker or creator (called the “grantor” or “settlor“), give a trustee, who could be you or another person, the right to hold title to and manage your property or assets for the benefit of a third party, the beneficiaries (those who may benefit under the trust).

- The Trust Agreement is the document that sets up a trust (aka, Deed of Trust, Declaration of Trust, or a Trust Deed). Paperwork varies by state.

- Like a will, trusts are established to provide legal protection for your assets and to make sure they are distributed according to your wishes.

- In this case, you are creating a trust to transfer your wealth to family members after your death with the option of including specific wishes about how they are distributed and giving specific privileges to the beneficiaries.

- Assets that already name a beneficiary or assets held in joint ownership will go directly to them after your death and do not need to be added to the trust to protect them further.

- After the trust is set up, you must re-register any property and securities added in the name of the trust. This means getting a new deed or other corresponding document for the asset.

- You should include protocols for determining your state-of-mind or other types of incapacity without a court proceeding.

- Trusts can substitute powers of attorney for the management of assets, but it is still best to name one for other legal issues that may come up.

- You need to sign your trust in front of a notary public and/or witnesses.

- Depending on the trust, you may need to file it with the state like you would a will. Check the rules for your state.

It may seem that trusts primarily benefit those who are very wealthy and are trying to avoid federal estate taxes and that the 99.9% who are less wealthy and do not have to worry about federal estate taxes don’t need to consider trusts, but trusts can be used for many reasons other than avoiding federal estate taxes.

In 2022 you can protect up to $12,920,000 from federal estate taxes. This will continue to increase to keep pace with inflation until 2025.

- A trust can protect assets from step-parents or even the beneficiary.

- Trust can be used for the benefit of the elderly or those with special needs to allow them to qualify for Medicaid or certain types of financial assistance.

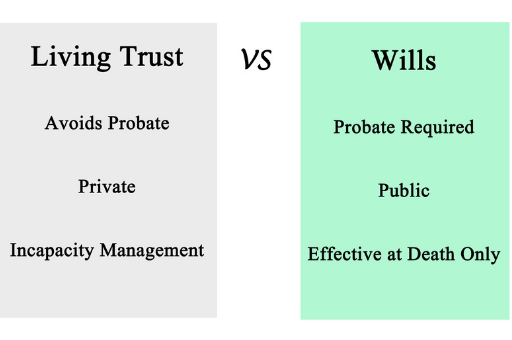

- Trusts allow you to transfer your estate to your family without going through the probate process.

- This allows immediate transfer of your assets to your beneficiaries without having to wait months to years for a will to clear probate.

- Trusts can protect your estate from creditors, certain taxes, and becoming public knowledge.

- The probate court continues to oversee any trusts created in a will to make sure it is being handled properly until it expires. This is not true of any trust created in a living trust.

- In many cases trusts can save time and reduce paperwork.

- A trust is usually more detailed and can be more specific about how you want your assets distributed and used. This may reduce challenges to your estate after your death.

- A trust can help you save on taxes, if you live in a state with its own estate tax.

- There are 13 states that have additional estate taxes which can range from $1,000,000-$12,920,000 for 2023.

- These limits make trusts useful for many more people in these states especially since some states tax on the entire estate if you are over the limit, not just the amount over the limit like the federal tax.

Guide to Understanding Trusts

It can be difficult to keep the various trust options straight. There are a number of ways to look at and compare the different trust choices to help you determine which is best for your situation.

One confusing aspect of trusts is that the name chosen for your trust does not necessarily describe the features and may be an abbreviated version. For example:

- A revocable living trust may be called a revocable trust since testamentary trusts are not revocable and adding ‘living’ is redundant; and

- A trust termed a family trust could be one of many types of trust such as living trust, joint tenancy revocable trust, or testamentary trust, depending on the habits of your estate planner.

Some options presented as types of trust are frequently a combination of the features that you chose for your trust.

Some options presented as types of trust are frequently a combination of the features that you chose for your trust.

- Do you want the trust to be created and begin to be managed before your death (living trust) or outlined in your will or a living trust to be created after your death (testamentary trust)?

- Are you able to fund it (funded trust) or not (unfunded trust)? A trust is only useful if funded.

If you create a living trust and can fund it, you have three choices to make.

- Do you want to be able to make changes to or close the trust after it is formed (revocable trust) or not be able to close or change the trust (irrevocable trust)?

- Additional features of a revocable living trust:

- You and your revocable trust share the same Social Security number, which is what prompts estate tax.

- The trust’s income and deductions are reported on your personal Form 1040 tax return, as they would if you continued to own the assets personally.

- Trust assets are available to creditors while you are the trustee.

- Additional features of an irrevocable living trust:

- Your irrevocable trust will have its own Social Security number.

- The trust’s income and deductions are reported on a Schedule K-1 (Form 1041).

- Trust assets are protected from creditors and lawsuits against you even while you are alive.

- Trust assets are not subject to estate tax after your death.

- Additional features of a revocable living trust:

- Would you like to manage the trust initially after designating a successor trustee if something happens to you, or appoint another trustee to manage the trust during your lifetime?

- A revocable trust is generally initially managed by you and all irrevocable trusts are managed by another trustee.

- You may have a co-trustee.

- Should you give your trustee emergency power to alter the trust (“Power to Amend Revocable Living Trust Agreement” or a Testamentary Power of Appointment) if needed or not allow it, even at your request?

Additional features to consider.

Additional features to consider.

- Do you want your adult beneficiaries to have control of the assets right after you die or have them managed by a trustee (Discretionary Trust) until they are truly capable of doing so? Discretionary trusts only apply to adult beneficiaries.

- Are you leaving any of your estate to minor children with a trust that exists through the death of your surviving partner (Credit Shelter Trust) or only just until they come of age? Minor children must have a trustee to manage the trust until they are of legal age.

- Do you want to lock in what each minor beneficiary gets with an individual trust or group them together in a Group or Pot Trust to allow the flexibility to adapt to individual needs?

- Do you have dependents with disabilities that will need a Special Needs Trust? Special needs trusts are only appropriate for disabled beneficiaries.

Here Are a Few Details That May Help Simplify Things

If you create a trust, unless otherwise specified only you can change it. Therefore:

- Living trusts are usually revocable before your death, although you can create an irrevocable living trust, and irrevocable if the trust exists after your death;

- A living trust also becomes irrevocable if you become incapacitated;

- Testamentary trusts are irrevocable as they are formed after your death; and

- If you want to give the trustee the right to alter the trust if you become incapacitated or after your death, you must specifically state such in the trust document or your will if the trust is created in your will.

A family trust is merely a description of any trust going exclusively to family (related by blood, marriage, or law [in the case of adoption] and not a type of trust.

A family trust is merely a description of any trust going exclusively to family (related by blood, marriage, or law [in the case of adoption]) and not a type of trust.

Whatever the type of trust or name given to it, your trust is the sum of all the terms, provisions, and other features it contains. Instead of trying to determine what type of trust you want, determine what features you want the trust or trusts to have.

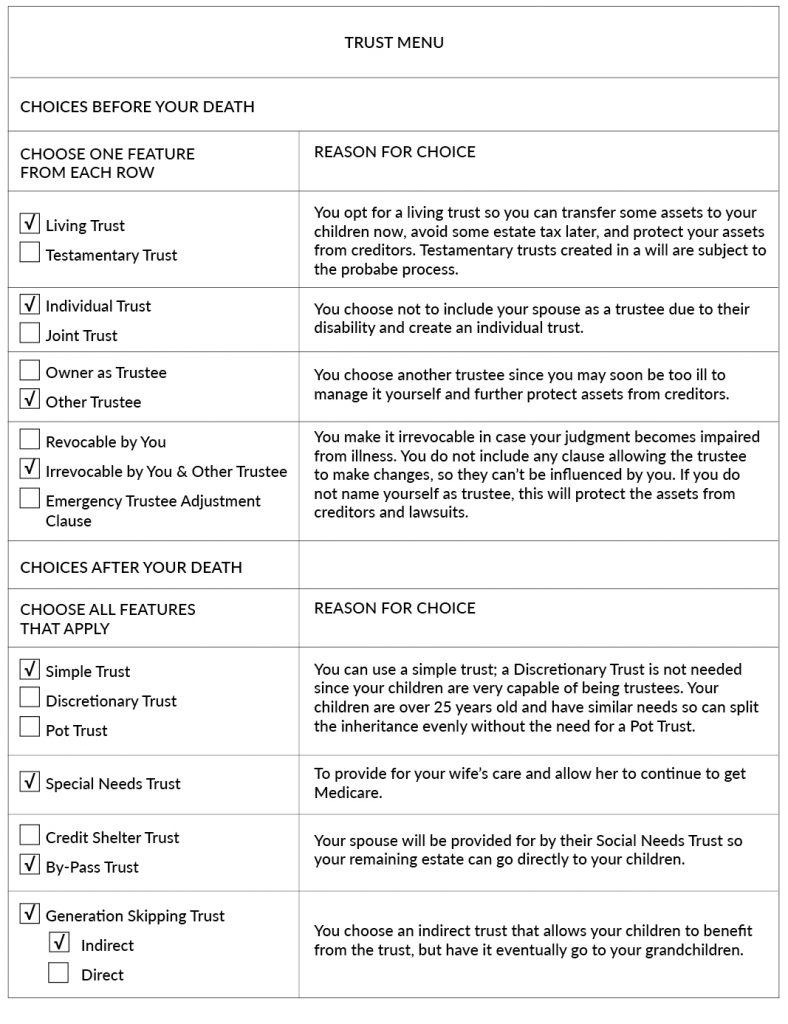

It may be best to think of creating a trust like going through a menu. For example, if you are creating a trust because you are ill and have two adult children with their own children, who are approaching college age, and a disabled spouse, you will be creating a Family Trust since only relatives are included.

It may be best to think of creating a trust like going through a menu. For example, if you are creating a trust because you are ill and have two adult children with their own children, who are approaching college age, and a disabled spouse, you will be creating a Family Trust since only relatives are included.

The last things to consider are time, cost, and results.

- Living trusts are more complicated than wills, need more planning, documentation, and up-front costs. However, the tax savings and avoiding an expensive probate process may make it worthwhile if your estate is large enough, although it is likely to require a professional.

- Testamentary trusts may be more complex and expensive, but they allow for more detail, clarity, and control of your assets after you die.