2023 Income Limits if You and/or Your Spouse Also Have a Retirement Account from Your Employer

Retirement Accounts

Updated: November 6, 2023

Retirement accounts contain money that you have set aside to use once you are retired. What makes these accounts different from other investments is that the federal government allows them to grow tax-free. However, you do not have easy access to the money when you are younger.

Retirement accounts contain money that you have set aside to use once you are retired. What makes these accounts different from other investments is that the federal government allows them to grow tax-free. However, you do not have easy access to the money when you are younger.

The Employee Retirement Income Security Act (ERISA) of 1974 sets the rules for retirement accounts that protects them, including from creditors, and allows you to receive tax benefits.

Like any savings plan, the earlier you start and the more you can add will leave you in a better position financially. In many cases you can make contributions automatically, though most accounts have a limit on how much you can deposit each year.

Like annuities, retirement accounts can be funded with pre- or after-tax dollars. However, unlike annuities, you can only add includible compensation, which means earned income.

Includible compensation can include:

- Individual wages, salaries, commissions, bonuses, and other amounts paid to you for your labor, generally any amount shown in Box 1 of your Form W-2;

- Net earnings from your business, minus any deduction allowed for contributions made to retirement plans on your behalf and further reduced by 50% of the your self-employment taxes, if you are self-employed or a partner in a partnership; and/or

- Money related to divorce, such as alimony, child support, or a settlement.

Includible compensation does not include:

- Rental income or other profits from property maintenance, such as interest and dividend income;

- Interest income;

- Pension or annuity income;

- Stock dividends and capital gains;

- Compensation that was deferred in a prior year;

- Income from non-income-producing partnerships;

- Income from Conservation Reserve Programs; and

- Other amounts you don’t include as income, such as foreign-earned income.

Once funded, the account then earns tax-deferred gains. The sacrifice for this is that you can’t withdraw untaxed contributions before 59½ years old without penalty and the federal government sets yearly limits on how much can be added to each type of account. Your employer may set their own limits on how much you can contribute, either a dollar amount or percent of your salary.

Like annuities, most retirement accounts have a limit on how long you can defer withdrawals. The limit is 73 years old (70½ if you turned that age before 2020) or age of retirement, whichever is older. The Roth IRA is an exception and has no minimum age requirements to start distributions.

Once funded, the account then earns tax-deferred gains. The sacrifice for this is that you can’t withdraw untaxed contributions before 59½ years old without penalty and the federal government sets yearly limits on how much can be added to each type of account. Your employer may set their own limits on how much you can contribute, either a dollar amount or percent of your salary.

Like annuities, most retirement accounts have a limit on how long you can defer withdrawals. The limit is 73 years old (70½ if you turned that age before 2020) or age of retirement, whichever is older. The Roth IRA is an exception and has no minimum age requirements to start distributions.

- At that point you must begin taking required minimum distributions (RMDs).

- RMDs are based on the value of your investments, age, and expected lifespan according to the Internal Revenue Service (IRS) life expectancy table.

- RMDs are initially 4% of your account’s balance and increase with age.

- This means that as you get older you must withdraw increasingly larger percentages of your account balance.

- A RMD calculator and detailed information about RMDs can be found on the AARP website.

- For each year you defer after that you will pay an excise tax penalty equal to 50% of the amount you should have withdrawn.

- All of the withdrawal from 401(k), 403(b), 457(b), profit-sharing plans, and traditional IRA (Individual Retirement Accounts) accounts is taxed as income, since it was funded by pre-tax dollars.

- Only the gains are taxed on withdrawals from Roth versions of these accounts, since they were funded by after-tax dollars

Employer Sponsored

Many retirement plans are sponsored by employers and allow you to contribute pre-tax or after-tax dollars. In some cases, the employer may match some or all of your contributions. Employers can receive up to $500 of tax credit per year if they create a 401(k) or SIMPLE IRA plan with automatic enrollment.

Many retirement plans are sponsored by employers and allow you to contribute pre-tax or after-tax dollars. In some cases, the employer may match some or all of your contributions. Employers can receive up to $500 of tax credit per year if they create a 401(k) or SIMPLE IRA plan with automatic enrollment.

If your employer offers them, they are available to full-time and part-time employees who work either 1,000 hours per year or have worked three consecutive years with at least 500 hours. You can only make deposits with funds from your salary.

Depending on the type of account, there are three types of contributions.

- Elective deferrals – pre-tax contributions you have taken out of your salary which are contributed directly into the account for your benefit.

- Non-elective contributions – untaxed contributions by your employer to your account, such as matching contributions, discretionary contributions, and mandatory contributions.

- After-tax contributions – contributions to Roth accounts or additional contributions you can make if your plan allows them.

Within the federal limit and any limit set by your employer, you can choose how much to deposit.

Some employers will match some or all of your contributions and get tax relief for them.

- Most will have a limit, which may or may not be the same as your contribution limit.

- Because of higher budgets, for-profit companies are more likely to match contributions, while non-profit companies with lower budgets are less likely to match contributions.

- Employers that provide employees a pension, such as for police officers, firefighters, other civil servants, ministers, school administrators, state college professors, and teachers will usually not match contributions.

While you are entitled to all of your contribution if you leave your job, you will not be entitled to all of your employer’s contribution until you are fully vested.

- Vesting indicates the percentage of your employer’s contribution you are entitled to.

- Vesting is usually tied to how long you have been employed.

- You will usually have to wait for full vesting with a 401(k). You should check with your employer about their vesting policy.

- You are usually fully vested as soon as you open a 403(b), which is offered by the government or non-profit organizations or you are employed in a business with less than 100 employees that offer a SAFE retirement plan or Safe Harbor 401(k).

- The Employee Retirement Income Security Act (ERISA) puts limits on the length of the vesting period.

If you change jobs you can either keep the account with your previous employer, move it, or cash it out. It can be difficult to choose among the options, but the decision is ultimately a financial one. You will be trying to balance the cost of services (fees) for moving the money with the possibility of making them up with a better return on your new account or investments.

If you change jobs you can either keep the account with your previous employer, move it, or cash it out. It can be difficult to choose among the options, but the decision is ultimately a financial one. You will be trying to balance the cost of services (fees) for moving the money with the possibility of making them up with a better return on your new account or investments.

- Your employer may require you to take your money out of their account or only allow you to stay in the account if you have a certain amount invested, but you cannot add additional funds.

- If desired or necessary, you can roll it over into an IRA. This may give you more choices such as lower fees, more control, or payment options.

- Some new employers will allow you to move the funds into the account they offer.

- You can cash it out, but you will lose the benefits of the account and usually pay surrender and service fees.

Employer retirement accounts can be qualified or non-qualified depending on whether or not they follow ERISA rules.

- Qualified retirement accounts like 401(k)s are those that are subject to all ERISA rules, such as tax-deferral, contribution limits, and when withdrawals can start without penalty.

- Non-qualified retirement accounts may not adhere to all ERISA rules, such as nondiscrimination rules.

- 403(b)s and 457(b)s have the same limits on contributions and withdrawal rules, but may not follow other rules and are usually considered non-qualified. This is especially true if your employer does not have a matching contribution program.

- 457(f)s are also non-qualified and do not have a limit on how much can be put into the account. They may be offered if you are a high-salaried employee.

The nondiscrimination rules in the ERISA assure that all employees of the company are eligible for the same benefits, no matter their position within the company.

- This keeps plans from for-profit companies (401ks) from treating highly-compensated employees and company executives differently when it comes to employer contributions.

- Plans from non-profit companies or governments (403b and 457b) are not usually at risk for this and are exempt from these rules.

- Companies that do not match contributions are also exempt from nondiscrimination rules.

If your adjusted gross income falls below a certain limit you may be eligible to take a non-refundable savers tax credit of up to $1,000 ($2,000 if married filing jointly) if you contributed to any type of employer-sponsored retirement plan.

Typical Investment Choices for Retirement Accounts

Certificates of Deposit (CDs) are securities issued by commercial banks and pay a preset rate of interest over the term of the agreement. The Federal Deposit Insurance Corporation (FDIC) often acts as a guarantor of these securities. This oversight makes CDs relatively low-risk.

Certificates of Deposit (CDs) are securities issued by commercial banks and pay a preset rate of interest over the term of the agreement. The Federal Deposit Insurance Corporation (FDIC) often acts as a guarantor of these securities. This oversight makes CDs relatively low-risk.

Money Market Funds invest in short-term (typically less than one year) securities commonly traded in the money market. While there may be some capital gains, most of the gains in value come from interest.

Mutual funds are a managed portfolio of investments with money from various investors that is pooled and invested in a variety of different financial securities including stocks and bonds.

- Rather than purchase shares of an individual stock, the manager of the 401(k) buys shares of a mutual fund.

- These transactions are handled by the mutual fund manager or through a broker, rather than on an open market (exchanges).

Exchange-traded funds are a type of security similar to mutual funds. The investments usually involve a collection of securities such as stocks, but can also be invested in any number of industry sectors or use various strategies. Unlike mutual funds, exchange-traded funds are listed on exchanges and the shares trade throughout the day just like ordinary stock.

U.S. Treasury Bonds (T-bonds) provide you or your 401(k) with steady interest income, usually every 6 months. It is important to know that you must hold the bond through to maturity, usually 20-30 years, to earn a bond’s full yield.

Corporate Bonds provide recurring interest income, but unlike the U.S. Bonds there is risk involved that varies significantly by the issuer. Your 401(k) manager needs to conduct a thorough review of any corporate bond security before investing directly or through a mutual fund.

Annuities are becoming more common after the 2019 SECURE Act reduced liabilities for companies offering retirement plans.

401(k)

401(k)s retirement plans are only available from your employer. If you work for a for-profit company, a 401(k) is the only retirement account of this type available. Some non-profit employers offer them, but it is less common.

401(k)s retirement plans are only available from your employer. If you work for a for-profit company, a 401(k) is the only retirement account of this type available. Some non-profit employers offer them, but it is less common.

Eligible employees can make tax-deferred contributions from their salary/wages on a post-tax (Roth) and/or pre-tax (traditional) basis. Employers may make matching or non-elective contributions to the plan and may also add a profit-sharing feature.

401(k)s from for-profit companies are more likely to be administered by mutual funds companies and to match some or all of your contributions.

Whether contributions are taken out before taxes (gross salary) or after taxes (take home salary) depends on which of the two types, traditional or Roth, you have. You may or may not have a choice of which one.

Traditional 401(k)

- Contributions are taken out of your gross salary and will not count toward your income tax.

- The Federal Government limit for regular employee contributions in 2023 is $22,500 — will increase to $23, 000 in 2024.

- If you are 50 years old or older in 2023 and have not contributed the maximum amount in previous years, you may also add an additional catch-up contribution of $7,500 per year, up to $30,000 total — $30,500 in 2024.

- All withdrawals will be taxed as income.

- If you are in a high tax bracket now, delaying income tax until retirement when your income may be lower makes financial sense.

Roth 401(k)

- Contributions are taken out of your take after-tax home salary.

- There are no federal limits on what you can contribute.

- Withdrawals from your contributions made after 59½ years old will not be taxed as income as long as the account has been funded for at least five years.

- Any earnings and matching contributions from the employer are pre-tax dollars and will go into a separate traditional 401(k) and be taxed at withdrawal.

- If you are in a low tax bracket now, paying income tax now rather than at retirement when you might have a higher tax bracket makes financial sense.

There is also a federal limit on total annual additions of employer contributions plus employee contributions (elective deferrals). It is the lesser of 100% of your includible compensation (earned income) for the year; or for 2023

The contributed funds are invested to increase the value of the 401(k). Your employer will usually present you with a few investment options for you to choose from.

- The options will frequently be a choice of conservative, middle, or high-risk investments or combinations of them. Choose the options based on your comfort level for risk.

- About 40% of companies offer a self-directed brokerage account (SDBA).

- An SBDA allows you to manage your own investments.

- It gives you direct access to a network of mutual funds.

- You may be able to invest in stocks, bonds, and exchange-traded funds.

- These investments are different from those available in the core plan.

- The more options you choose and the more complex the investments, the higher the fees.

- The principal and earnings accumulate tax-free until they are withdrawn, when they are taxed as income according to the tax status of contributions and your tax bracket at that time.

If your employer’s plan allows it, you can borrow money from a 401(k) plan before retirement in an amount that is the smaller of 50% of your vested balance up to $50,000. If you have less than $10,000 invested, you can borrow up to your vested account balance.

- Generally, you have to include any previously untaxed amount of the distribution in your gross income in the year in which the distribution occurs. You may also have to pay an additional 10% tax on the amount of the taxable distribution, unless you:

- Are at least age 59 ½, or

- Qualify for another exception.

- You may need to pay interest on the loan, but the payment goes back into your 401(k).

- The IRS requires that you repay the loan within 5 years and that payments must be made quarterly in equal amounts that cover principal and interest.

403(b)

403(b) plans can only be offered by the government or non-profit organizations, such as a public education institution, religious organization, or 501(c)(3) Tax-Exempt Organization.

403(b) plans can only be offered by the government or non-profit organizations, such as a public education institution, religious organization, or 501(c)(3) Tax-Exempt Organization.

- They are more likely to be administered by insurance companies.

- 403(b)s offer a much more limited range of investment options, usually only mutual funds and annuities. This is usually to avoid high-risk investments.

- Eligible employees may make contributions from their salary/wages on a post-tax or pre-tax/tax deferred basis.

- Organizations that offer 403(b)s can, but are less likely to match contributions.

- 403(bs) are exempt from many Employee Retirement Income Security Act (ERISA) rules, especially if they do not match contributions.

A 403(b) works just like a 401(k) including traditional and Roth forms, a federal government limit for regular employee contributions in 2023 of $22,500, the ability to add $7,500 in catch-up contributions if you are 50 years old or older, and the ability to take loans if allowed by your employer. If you have worked for your employer for at least 15 years and your employer is considered a “qualified organization” you are entitled to a Lifetime Catch-up that lets you contribute up to an additional $3,000 per year, up to a maximum of $15,000.

There is a federal limit on total annual additions of employer contributions plus employee contributions (elective deferrals). It is the lesser of 100% of your includible compensation (earned income) for the year or for 2023:

Unlike a 401(k) plan, if your 403(b) plan does not offer an employer match and you have over 15 years of service to the company you can make additional catch-up contributions to the plan of the lesser of:

- $3,000;

- $15,000 reduced by the sum of prior years’ 15-year catch-up deferrals; or

- $5,000 x years of service with the employer, minus the total of all elective deferrals made to a 403(b), 401(k), SARSEP or SIMPLE IRA plan maintained by the employer, including the 15-year catch-up, but excluding the age 50 catch-up.

Thrift Savings Plan

- A limit for regular employee contributions in 2023 of $22,500.

- The ability to add $7,500 in catch-up contributions if you are 50 years old or older.

- Limit on total annual additions of employer contributions plus employee contributions (elective deferrals). It is the lesser of 100% of your includible compensation (earned income) for the year or for 2023

457(b)

- Traditional and Roth forms;

- A federal government limit for regular contributions in 2023 of $22,500, and the ability to add $7,500 in catch-up contributions if you are 50 years old.

- You can take out a loan from your 457(b) if your plan permits it.

- The maximum you can borrow is half of the vested account balance, up to $50,000

- If your balance is less than $10,000, you can take out all of it if your plan allows it.

- You have to repay the loan within five years in payments made at least once a quarter.

Like a 403(b), a 457(b):

- Usually only invests in mutual funds and annuities; and

- Is offered by organizations that are less likely to match contributions; more so since 457 (b) plans are usually offered by organizations that have pension plans for retired employees such as police officers, firefighters, or other civil servants.

There are a number of differences from a 401(k) and 403(b).

There are a number of differences from a 401(k) and 403(b).

- There is no combined annual contribution limit, any contributions from your employer reduce what you can contribute by that amount. This is rarely a limited since most government employers do not offer to match contributions.

- In your final three years before retirement, you can contribute the lesser of:

- Twice the annual limit, up to $45,000 a year in 2023; or

- The basic annual limit plus the amount of the basic limit not used in prior years (only allowed if not using age 50 or over catch-up contributions).

- As long as you don’t exceed the $22,500 limit in the year 2023, you can contribute up to 100% of your salary.

- If you do not take advantage the 50 or over catch-up option, you can resort to unused contribution rollovers.

- These allow you to add any amount below the limit that you did not contribute last year to this year’s contribution.

- For example, if you only contributed $12,000 to your 457(b) plan in 2021 ($7,000 under the 2021 limit), you can contribute up to $27,500 in 2022 ($7,000 + $20,500).

- You won’t pay a 10% penalty fee if you withdraw money after leaving your job or retire before 59½ years old.

- Your money is not protected from creditors.

You can have a 457(b) and a 403(b) (or rarely a 401k) at the same time and be able to contribute up to the limit for both.

457(f)

A 457(f) plan is a supplement to a 457(b) plan.

- It is only offered to a select group of highly paid or key management employees of non-governmental tax-exempt organizations, such as hospitals, universities, and credit unions.

- The employee can make contributions up to the yearly limit — in 2023 this is $22,500 plus $7,500 in catch-up contributions if you are at least 50 years old.

- The exemption from the ERISA rules allows employers to make unlimited contributions to the plan as a financial incentive for these employees.

457(b) and 457(f) plans usually work in combination with each other, but can be treated as separate entities.

Profit-sharing Plans

A profit-sharing plan is a retirement plan created for you but funded solely by your company. Also known as a deferred profit-sharing plan, it allows you to receive a percentage of your company’s profits based on its earnings. Any size company can set one up.

A profit-sharing plan is a retirement plan created for you but funded solely by your company. Also known as a deferred profit-sharing plan, it allows you to receive a percentage of your company’s profits based on its earnings. Any size company can set one up.

- The company decides how much of their profits they want to share and then determines what they allocate to you.

- Contributions amounts can be a percentage of your salary or determined by a formula based on your salary and your company’s earnings for that quarter.

- The amount of your salary will be used to calculate what percentage of the company’s total salary payments is yours.

- The amount of your salary that can be considered for a profit-sharing plan is limited, $330,000 in 2023.

- That number is then multiplied by the total profits being shared, if any.

- They are typically added to your account quarterly or annually.

- Once funded, the account grows tax-deferred like the other retirement accounts.

- Like all non-Roth accounts, the withdrawals are taxed as income.

- The company has all the control, but there are some rules they need to follow.

- The 2023 contribution limit for your company is the lesser of 100% of your salary or $66,000 ($73,500 for those 50 years old or older).

- Companies have to follow nondiscrimination rules, in other words the profit-sharing plan cannot discriminate in favor of highly compensated employees.

- Like other retirement plans, you will pay a 10% penalty for any funds you withdraw from the account before 59½ years old.

- After leaving the company, you can transfer the money into a traditional IRA without penalty.

- Profit-sharing plans usually have a vesting schedule that determines how long you have to work for your company before you are entitled to the full amount.

- A profit-sharing plan does not restrict the company from also offering a 401(k).

- You can take your funds in the form of cash or company stock.

SIMPLE IRA Plan

A Savings Incentive Match Plan for Employees (SIMPLE) IRA is a savings plan available to small businesses with fewer than 100 who earn more than $5,000 per year and do not offer another retirement plan. To allow for growth of a business, the employer can still offer the plan for two years after the company exceeds 100 employees, after which they need to switch to a standard IRA plan.

A Savings Incentive Match Plan for Employees (SIMPLE) IRA is a savings plan available to small businesses with fewer than 100 who earn more than $5,000 per year and do not offer another retirement plan. To allow for growth of a business, the employer can still offer the plan for two years after the company exceeds 100 employees, after which they need to switch to a standard IRA plan.

IRS rules prohibit your company from offering you other types of retirement plans if you are covered by a SIMPLE IRA.

SIMPLE IRAs do not require non-discrimination rules, creation of vesting schedules, or tax reporting at the plan level; they are easier and less expensive to set up and manage than the previously described traditional plans.

Since businesses must match workers’ contributions to the plan, the SECURE Act gives them tax incentives to set it up. This tax credit is in addition to the 50% of necessary eligible start-up costs credit they already receive, up to a maximum of $500 per year for the first three years of the plan.

The plan allows pre-tax contributions by both employees and employers. The amount of possible savings is less than other types of plans.

You must have earned at least $5,000 in compensation in any two previous calendar years and be expected to earn at least $5,000 in the current year to be able to participate.

Your contributions are tax-deductible and the 2023 limit for contributions is $15,500. If you are 50 years old or older you may contribute an additional catch-up amount of $3,500 per year. You must fill out a SIMPLE IRA adoption agreement to open your account.

Employers must contribute to the account; you are 100% vested in employer contributions from the beginning of the account and you will receive the full amount whenever you leave. There are two options for employer contributions.

- Your employer matches your contributions.

- Your employer can match 3% of your yearly compensation up to $15,500 in 2023 (salary of $516,667).

- They may also choose to match at least 1% of your salary if it is for no more than two out of the five years that ends with (and includes) the year for which the election is effective. Your employer must notify you of the lower match between 30-90 days before the 60-day election period for the calendar year.

- Although the employee contribution may be higher, the disadvantage is that if you do not contribute, you would have no retirement savings.

- Alternatively, your employer can opt to make contributions for every employee, whether or not they elect to contribute.

- Your contribution will be matched up to 2% of your salary or $6,600 in 2023 (salary of $330,000), whichever is lower. Your employer must notify you if they elect this option between 30-90 days before the 60-day election period for the calendar year.

- Although the employee contribution may be lower, the advantage of this option is that you will still have money in the account, even if you don’t contribute.

There are a variety of investment choices, including growth, growth and income, income, and specialized funds such as sector funds or target-date funds.

Unlike a 401(k), a SIMPLE IRA cannot be rolled over into a traditional IRA without a two-year waiting period from the time you first joined a plan. SIMPLE IRA accounts can accept transfers from SEP IRAs, traditional IRAs, and employer-sponsored plans such as a 401(k).

Unlike a 401(k), you cannot take loans from the account or get a penalty-free hardship withdrawal, but like other accounts, if you withdraw money before 59½ years old you will pay a 10% early withdrawal penalty on the taxable portion of the money. This penalty is 25% if you withdraw funds within the first two years.

After two years contributions and earnings may be transferred over tax-free to other individual retirement accounts and retirement plans and must eventually be distributed following the IRA-required minimum distribution rules.

Simple 401(k) Plan

A SIMPLE 401(k) is a savings plan available to businesses with fewer than 100 employees who earn more than $5,000 per year and do not offer another retirement plan. To allow for growth of a business, the employer can still offer the plan for two years after the company exceeds 100 employees, after which they need to switch to a standard 401(k) plan.

IRS rules prohibit your company from offering you other types of retirement plans if you are covered by a SIMPLE 401(k), but:

- You can have and contribute to your own individual retirement account: and

- Your employer can provide an additional plan for you if you do not meet the qualification guidelines.

SIMPLE 401(k)s do not require non-discrimination rules, creation of vesting schedules, or tax reporting at the plan level; they are easier and less expensive to set up and manage than traditional plans.

To participate you must be at least 21 years old, must have been employed at least one year, and earned at least $5,000 in SIMPLE compensation from your employers in the past year.

Your contributions are tax-deductible and the 2023 limit for contributions is $15,500. If you are 50 years old or older you may contribute an additional catch-up amount of $3,500 per year.

Employers must contribute to the account; you are 100% vested in employer contributions from the beginning of the account and you will receive the full amount whenever you leave. There are two options for employer contributions.

- Your employer can match your contributions dollar-for-dollar.

- Your employer can match 3% of your yearly compensation up to $15,500 in 2023 (salary of $516,667) if you choose to contribute.

- Although the employee contribution may be higher, the disadvantage is that if you do not contribute, you would have no retirement savings.

- Alternatively, your employer can opt to make contributions for every employee, whether or not they elect to contribute.

- Your contribution will be matched up to 2% of your salary or $6,600 in 2023 (salary of $330,000), whichever is lower. Your employer must notify you between 30-90 days before the 60-day election period for the calendar year if they elect this option.

- Although the employee contribution may be lower, the advantage of this option is that you will still have money in the account, even if you don’t contribute.

Unlike a SIMPLE IRA, loans can be taken from the plan.

Withdrawals may be subject to a 10% penalty if you are less than 59-½ years old, unless you qualify for a hardship withdrawal. Unpaid loans are considered early withdrawals if not paid back on time.

Simplified Employee Pension

A Simplified Employee Pension (SEP) plan or 408(k) plan gives employers the ability to contribute to traditional IRAs (SEP-IRAs) set up for employees.

A Simplified Employee Pension (SEP) plan or 408(k) plan gives employers the ability to contribute to traditional IRAs (SEP-IRAs) set up for employees.

An SEP plan has lower start-up and operating costs than conventional retirement plans, but is much different than a SIMPLE IRA. It is like a traditional IRA that your employer contributes to.

- It is designed for self-employed and small businesses, but is available for any size business.

- To qualify to participate you must at least be 21 years old, have three years of employment within the last five years, and earn at least $750 compensation per year.

- Participation in traditional IRAs and Roth IRAs does not disqualify you from participating.

- You may be disqualified if you are covered in a union agreement that bargains for retirement benefits or are a nonresident alien that does not receive U.S. wages or other service compensation from your employer.

- Only the employer makes contributions, not you or other employees. There are two exceptions.

- You can contribute to a Salary Reduction Simplified Employee Pension Plans created before 1997. However, elective salary deferrals or catch-up contributions are no longer allowed.

- If you are self-employed, you can contribute up to 20% of your net self-employment earnings towards your account.

- The contributions can vary from year to year based on how well the company is doing.

- Although there may be no contributions some years, the maximum can be higher than other retirement plans.

- In 2023, your employer can make contributions up to $66,000 or 25% of your net earnings from self-employment up to $330,000, whichever is lower.

- The funds are usually put into traditional IRAs, known as SEP-IRAs, set up for each eligible employee and are taxed accordingly.

- There are a variety of investment choices, but it is the IRA trustee that chooses the investments and you who make specific investment decisions.

- You are always 100% vested in the account and will receive the full amount when you leave, whenever that is.

- You cannot take loans from the account.

- Like other accounts, if you withdraw money before 59½ years old, you will pay a 10% early withdrawal penalty on the taxable portion of the money and you must begin minimum withdrawals before 73 years old (70½ if you turned that age before 2020).

- Contributions and earnings may be transferred over tax-free to other individual retirement accounts and retirement plans and must eventually be distributed following the IRA-required minimum distributions.

Qualified Automatic Contribution Arrangement

A Qualified Automatic Contribution Arrangement (QACA) can be part of most employer-sponsored retirement plans. It is a rule established under the Pension Protection Act of 2006 intended to increase employee participation in self-funded retirement plans by automatically enrolling them, unless they opt out. It is not subject to non-discrimination rules.

If you want to accept the plan your contributions start at 3% and gradually increase with each year you participate. If you do not you must inform your employer of your preference.

Employer contributions must be either of:

- 100% of your contribution up to 1% your compensation, plus a 50% matching contribution for your contributions from 1%-6% of your wages; or

- A non-elective contribution of 3% of compensation to all employees. That

There is a two year vesting period. There is a similar auto enrollment arrangement called an eligible automatic enrollment arrangement where you are 100% vested in employer contributions from the time the plan begins and you can withdraw funds within 30-90 days after your first automatic enrollment contribution was withheld from your wages.

Saver’s Tax Credit

Employees with low income find it difficult to save for retirement. The retirement savings contribution credit, or saver’s credit, offers eligible individuals with low-income and lower-middle-income a tax credit if they contributed to an employer-sponsored 401(k), 403(b), SIMPLE, SEP, thrift savings plans (TSP), or governmental 457 plans, an ABLE plan, or a traditional and/or Roth IRA.

You are eligible for this income tax credit in 2023 if the adjusted gross income (AGI) reported on your Form 1040 series return is $36,500 or less ($54,750 head of household or $73,000 if married filing jointly) and you are not less than 18 years old, a full-time student, or claimed as a dependent by another taxpayer.

If eligible, you can receive up to a $1,000 ($2,000 if married filing jointly) reduction in your income tax for the year, although your specific amount of the credit is based on your contributions to the retirement plans listed above, tax filing status, and AGI. The credit rate reduces from, 50% to 20% to 10% as your income increases.

2023 Saver’s Credit

Credit Rate/Tax Reduction | Married Filing Jointly | Head of Household | All Other Filers* |

50% of your contribution | AGI up to $43,500 | AGI up to $32,625 | AGI up to $21,750 |

20% of your contribution | AGI $43,501- $47,500 | AGI $32,626 – $35,625 | AGI $21,751 – $23,750 |

10% of your contribution | AGI $47,501 – $73,000 | AGI $35,626 – $54,750 | AGI $23,751 – $36,500 |

0% of your contribution | AGI more than $73,000 | AGI more than $54,750 | AGI more than $36,500 |

*Single, married filing separately, or qualifying widow(er) | |||

Solo 401(k)

A solo 401(k) or individual plan is both an employer sponsored and individual retirement plan. It is available if you are self-employed and have no full-time employees, aside from your spouse. If your spouse works for your business, both of you may contribute to a solo 401(k) up to the individual limits described below. There is no equivalent solo 403(b)..

Solo 401(k)s come in two varieties, both of which will grow tax-free until you begin to withdraw the money.

- Traditional solo 401(k) – your contributions come from your gross (before income tax) income and you pay income tax when you withdraw the funds in retirement.

- Roth solo 401(k) – your contributions come from your net income, but you pay no income tax when you withdraw the funds in retirement.

When you are self-employed you are both employee and employer and you have much more control over investments.

- You can contribute larger sums each year. Your maximum contribution is the lesser of:

- The 2023 annual contribution limit of $66,000 ($73,500 if you’re 50 years old or older); or

- Your employee contribution, $22,500 in 2023 ($30,000 if you’re 50 or older), plus 25% of your net self-employment income (all your self-employment earnings minus business expenses, half your self-employment tax, and money you contributed to your solo 401(k) for your employee contribution).

- The drawback is that you will pay both individual and employer fees to open and maintain the account.

You must make any employee contributions by December 31st, but you have until the tax-filing deadline for the year, usually April 15th of the following year, to make your employer contribution.

Federal law prohibits you from withdrawing your solo 401(k) funds without penalty before 59½ years old, unless you use the money for a qualifying exception, such as a first-home purchase or large medical expenses. For a 10% early withdrawal penalty on the taxable portion of the money, you can withdraw Roth solo 401(k) contributions for other expenses at any time before then as long as you’ve had the account for at least five years.

If you have a second job where you are an employee and have access to a 401(k) through your employer, your contribution limits are a combination of your employer 401(k) and solo 401(k), not to each separately.

Individual Retirement Accounts

If your employer does not offer a retirement account or contribution matching or if they do and you would like to have another retirement account, you can open an individual retirement account (IRA). An IRA is a type of retirement account to which individuals can make contributions where the investments in the account grow tax-deferred. They are available at financial-services companies like large banks, brokerage companies, federally insured credit unions, and savings and loan associations. The institution will manage your account by investing the money according to your preferences.

Each spouse can have their own IRA under their name and tax identification number, but joint IRA accounts do exist.

You can also set up an IRA in your name for your non-working spouse called a Spousal IRA. It is a separate account that functions the same as yours and does not interfere with the ability to contribute to yours. The two accounts allow your family to double your annual savings. To qualify for a spousal IRA:

- You must be married and file a joint tax return;

- The total contribution for both of you must not exceed the taxable earned income reported on your joint tax return; and

- Contributions to one IRA cannot exceed the contribution limits for that IRA.

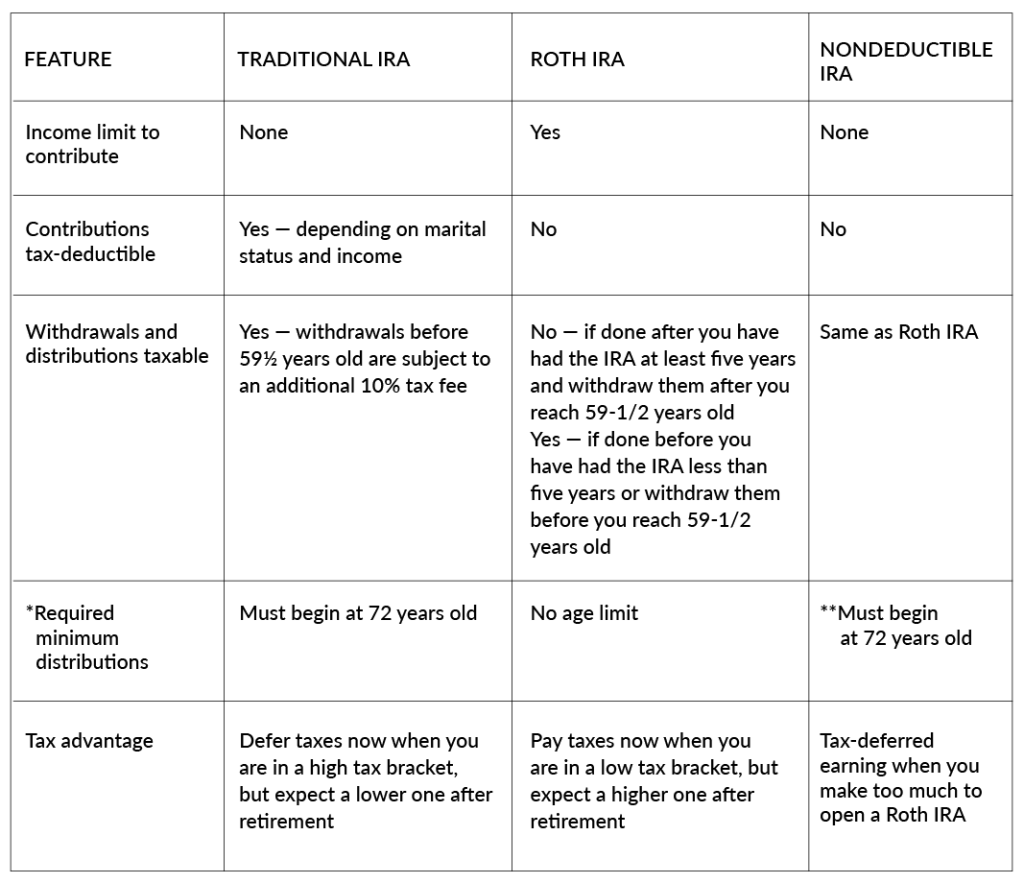

There are different types of IRAs, non of which have an age limit to contribute. The biggest differences between them are when you pay income taxes, whether or not there are modified adjusted gross income eligibility limits to contribute, and any age limits for required minimum distributions.

Each company will have their own rules, choices of investments, and service fees.

- It is important to compare what services they charge for, what the fees are, and if they charge you an account inactivity fee if it’s been too long since you checked on your investments.

- What your money is invested in affects your long-term earnings much more than the company you use. Get specific details about what investments they will make with your money.

- There is a lot of variability in the range of investments they offer. Some are quite diverse, while others are rather restrictive.

- Your risk tolerance and investment preferences should be the major factors in determining your choice of IRA provider.

- Most institutions will have minimum account balances, but they vary significantly.

- You must be able to contribute at least that amount to open the IRA.

- You will need another investment option if you don’t.

- If you plan on banking with the same institution, see if your IRA account comes with additional banking products or if they will waive or lower some of their fees.

- You should receive an IRA disclosure statement and IRA adoption agreement and plan document that includes everything you need to know about your specific account.

IRA contributions can be made all at once or over time.

- There are yearly limits to the amount you can contribute. The Federal Government limit for regular contributions in 2023 is the lesser of $6,500; or your includible compensation (total taxable compensation) for that year, meaning you can only add money that you earned that year.

- If you are 50 years old or older you may add an additional $1,000 per year. This is known as a catch-up contribution.

- The limit may apply to each type of account you have or the combined total of both accounts.

- You can contribute up to the limit to both an IRA and an employer sponsored retirement plan in the same year.

- You can contribute to both a traditional IRA and Roth IRA account in the same year, but your combined contribution cannot exceed the IRA limit for that year, $6,500 ($7,500 if you are 50 years old or older) in 2023.

- Any contributions that happen up to your tax deadline will count toward the previous calendar year.

- The IRA contribution limit does not apply to rollover contributions, and qualified reservist repayments.

Once opened, the funds in your IRA are invested to increase the value of the IRA. In general, IRAs invest in the same things as 401(k)s, 403(bs), and 457(b) plans, but offer a wider array of these investments.

The principal and earnings accumulate tax-free until they are withdrawn, when they may be taxed as income, depending on the IRA type, and according to your tax bracket at that time. You can choose your type of IRA based on when you can better afford income tax on your money, now or after your retirement.

You cannot take loans from an IRA account, although there are specific times outlined below you that can remove funds without penalty before you reach 59½ years old.

Traditional IRA

Unlike a Roth IRA, there is no modified adjusted gross income limit to being able to contribute to a traditional IRA, although there are income limits for tax deductible contributions if you have a retirement account from your employer.

Unlike a Roth IRA, there is no modified adjusted gross income limit to being able to contribute to a traditional IRA, although there are income limits for tax deductible contributions if you have a retirement account from your employer.

Like most other retirement accounts, traditional IRA contributions must be made from income earned in the same year as the contribution unless you are rolling over another type of retirement account.

Contributions are usually tax-deductible. If you are in a high tax bracket now, delaying income tax until retirement when your income may be lower makes financial sense. You can claim the tax deduction even if you do not itemize deductions on your tax return.

Whether you can make tax-deductible contributions to your traditional IRA depends on your marital and filing status, whether or not you and/or your spouse have another retirement account from your employer, and your modified adjusted gross income.

MARITAL AND FILING STATUS | RETIREMENT ACCOUNT FROM EMPLOYER | TAX-DEDUCTIBLE | |

Single, head of household or living apart from your spouse | Yes | Less than $73,000 | Entire contribution |

$73,000 to less than $83,000 | Phase-out range | ||

$83,000 or more | Not deductible | ||

Married filing jointly or qualifying surviving spouse | You, irrespective of your spouse having one | Less than $116,000 | Entire contribution |

$116,000 to less than $136,000 | Phase-out range | ||

More than $136,000 | Not deductible | ||

Either you or Spouse | Less than $10,000 | Part of contribution | |

$10,000 or more | Not deductible | ||

If you are over the tax-deductible income limit you can still contribute up to the federal limit but it can be difficult to keep track of which contributions are after-tax contributions. In addition, you will need to file an IRS Form 8606 for these contributions each year so you’re not taxed again when you take retirement distributions.

It may be better to put that money into other investments, like a Roth or nondeductible IRA or use the money to contribute up to the limit for your employer sponsored account | |||

As with 401(k)s, you’ll pay taxes on the tax-deductible money once you withdraw it and an additional 10% penalty on the taxable portion of the withdrawal if this is before you are 59½ years old, with some exceptions. Although you’ll owe taxes on the distribution, there will be no penalty if you withdraw:

- Any funds to pay for qualified college expenses;

- Up to $10,000 toward the purchase or restoration of your or a qualified family member’s (your spouse, children/stepchildren or grandchild, parent/in-law or other ancestor) first home;

- Up to $5,000 in the year following the birth of adoption of a child;

- Enough funds to pay for unreimbursed medical expenses exceeding 7.5% of your adjusted gross income or for health insurance premiums for you, your spouse or children when you are unemployed;

- Any funds during any active military deployment exceeding 179 days if you are a reservist;

- Any funds if you are totally or permanently disabled;

- Funds that were seized by the IRS (levy) for payment of debts;

- Any amount that was considered a return on non-deductible contributions; or

- By starting a series of distributions called 72(t) payments from your IRA that are spread equally over your life expectancy.

- You must take at least one distribution each year

- You can’t modify the schedule of payments until five years have passed or you’ve reached age 591/2, whichever is later.

- The amount of the withdrawals must be based on an IRS-approved calculation that involves your life expectancy, your account balance, and interest rates.

Roth IRA

A Roth IRA is funded with after-tax dollars. You can contribute to a Roth even if you have a 401(k). Whether you can contribute directly to a Roth IRA depends on your marital status and modified adjusted gross income.

2023 Income Categories

Marital and Filing Status | Modified Adjusted Gross Income | Ability to Contribute |

Single, head of household, or married filing separately and you did not live with your spouse at any time during the year | Less than $138,000 | Up to limit |

$138,000 to less than $153,000 | Less than limit | |

More than $153,000 | Unable to | |

Married filing jointly or qualifying surviving spouse | Less than $218,000 | Up to limit |

$218,000 to less than $228,000 | Less than limit | |

More than $228,000 | Unable to | |

Married filing separately and you lived with your spouse at any time during the year | Less than $10,000 | Up to limit |

More than $10,000 | Unable to |

You can invest in things other than the traditional ones if you choose a self-directed Roth IRA.

You can invest in things other than the traditional ones if you choose a self-directed Roth IRA.

You can circumvent the income limits by starting with a traditional or nondeductible IRA that has no income limits and convert it to a Roth IRA following specific rules. This is referred to as a Backdoor Roth IRA.

Contributions are not tax deductible; you pay income taxes on your contributions.

- Like a traditional IRA only earned income can be contributed.

- Unlike a traditional IRA:

- Roth IRAs can be funded from many sources such as personal contributions, spousal IRA contributions, transfers from savings, rollover contributions from other retirement accounts, and conversions from other IRA types; and

- You can make contributions to your Roth IRA after you reach age 70½.

- You must report all contributions on an IRS Form 8606.

- You must make any contribution before the IRS tax-filing deadline of April 18 in 2023.

- If you are in a low tax bracket now, paying income tax now rather than at retirement when you might have a higher tax bracket makes financial sense.

Having already paid income tax has many advantages.

- You do not have to have owned the Roth IRA for a specific time before you can withdraw funds, but penalties and income taxes will vary.

- You can withdraw your original contributions whenever you want without penalty or income tax. The IRS will always assume your original contributions come out first when you withdraw money from your Roth IRA.

- You won’t pay income taxes or penalties on the financial gains if you have had the Roth IRA at least five years and withdraw them after you reach 59½ years old.

- If you have reached 59½ years old but haven’t had the account for 5 years, there’s no penalty but you’ll owe income tax on any earnings that you withdraw.

- You will pay a 10% penalty and income tax on any financial gains/earnings withdrawn before 59½ years old, unless the money is used for the same exemptions described in the Traditional IRA section above.

Unlike annuities and employer sponsored retirement plans, there is no limit on how long you can defer withdrawals.

You can arrange to have Roth IRA funds transferred to a living trust so you’re able to use them when you are alive and disperse them as you wish to your beneficiaries after your death.

Nondeductible IRA

Nondeductible IRAs allow you to grow your account without paying taxes until gains are withdrawn. They blend some features of traditional and Roth IRAs.

- Contribution limits are the same as either the traditional IRA or Roth IRA, the lesser $6,500 ($7,500 if you are 50 years old or older) or your total taxable compensation for that year.

- Like a traditional IRA:

- There is no modified adjusted gross income limit to contribute; and

- Withdrawals on investment gains will be taxed according to your tax bracket.

- Like a Roth IRA:

- The contributions are made with after-tax dollars;

- You can withdraw contributed, not earned, money after 59½ years old without paying taxes; and

- You must report your nondeductible IRA contributions each year using IRS Form 8606.

The major reasons to opt for a nondeductible IRA is when you:

- Have too much annual income to qualify for a Roth IRA — more than $153,000 in 2023;

- Have an employer sponsored retirement account (401k, 403b, or 457b);

- Are otherwise ineligible to open a Roth IRA; and/or

- Want to contribute extra savings towards retirement in a tax-deferred account.

Unlike most other IRAs, 401(k)s, and other salary deferral plans, you can make contributions to a non-deductible IRA up to the IRS tax-filing deadline — April 18 in 2023.

Rollover IRAs

Rollover IRAs are traditional IRAs that receive funds from another retirement account before you can remove money without penalty at 59½ years old. There are advantages of doing this, such as moving money from an employer sponsored to an individual retirement account to have more control over the investments or moving the money to a less restrictive IRA, whether it’s to have easier access to the money or not have income limits.

Rollover IRAs are traditional IRAs that receive funds from another retirement account before you can remove money without penalty at 59½ years old. There are advantages of doing this, such as moving money from an employer sponsored to an individual retirement account to have more control over the investments or moving the money to a less restrictive IRA, whether it’s to have easier access to the money or not have income limits.

Most payments you receive from a retirement plan or IRA before this age can be “rolled over” by depositing the payment in another retirement plan or IRA within 60 days. The money can also be rolled over by having the distribution go directly to the new account. You can roll over all or part of any distribution except:

- Required minimum distributions;

- Loans treated as a distribution;

- Hardship distributions;

- Distributions of excess contributions and related earnings;

- Withdrawals coming from automatic contribution arrangements;

- Distributions to pay for accident, health or life insurance;

- Dividends on employer securities;

- S corporation allocations treated as deemed distributions; or

- A distribution that is one of a series of substantially equal payments.

- This is usually done if you lose your career and therefore your major source of income.

- This basically locks you into taking at least one distribution per year for at least five years or until you turn 591/2, whichever comes last.

- You usually set this up through a financial advisor or directly with your IRA institution.

Tax implications of rollovers can be complicated and best discussed with your agent or plan administrator.

Inheriting Retirement Accounts

Like an annuity, you may use your retirement as an inheritance tool by naming primary (and possibly contingent) beneficiaries if you die before the end of the retirement account term or it is depleted. The process of naming a beneficiary that is not your spouse is complicated and should be handled by a financial advisor that understands the rules.

Like an annuity, you may use your retirement as an inheritance tool by naming primary (and possibly contingent) beneficiaries if you die before the end of the retirement account term or it is depleted. The process of naming a beneficiary that is not your spouse is complicated and should be handled by a financial advisor that understands the rules.

The primary beneficiary, usually your surviving spouse, will get the money if they claim it. If they have passed away or do not claim the funds, the money then goes to the contingent beneficiaries. Any other beneficiary is free to decline any or all of the account and defer to the next beneficiary. There are three types of beneficiaries:

- Eligible designated beneficiaries, including your spouse and children less than 18 years of age, disabled or chronically ill individuals, and any other individual who is not more than 10 years younger than you at your death;

- Designated beneficiaries are individuals not included in the list above; and

- Not designated beneficiaries, which typically include estates, charities, and trusts.

The beneficiary who accepts the account cannot deposit additional funds and must decide how they’d like to receive their inherited funds. The options available to them are similar to those you had when the retirement account was yours. However, they will need to be aware of some minor differences and a few unique to inherited retirement accounts that will depend on the following factors.

- Whether they are your spouse, a non-spouse or an organization;

- Your age at death;

- Their age in relation to yours at death;

- Their health status; and

- The type of account and any other rules specific to your retirement account.

Options available to beneficiaries of your retirement account

Your surviving spouse can transfer the money from any type of retirement account into their own retirement account. They have 60 days from receiving distribution to do this, as long as the distribution is not a required minimum distribution (RMD). They will then follow the specific rules of the account type based on their age (less than or more than 59½ years old).

- If you had already begun receiving RMDs your surviving spouse must continue to receive the distributions as calculated or submit a new schedule based on their own life expectancy.

- If you had not yet committed to an RMD schedule or reached your required beginning date, your spouse has a five-year window to withdraw the funds, which would then be subject to income taxes.

Your spouse can take over your IRA account and manage it as if it were their own, including the calculation of required minimum distributions. If you have a 401(k) or similar employer sponsored plan it must be rolled over into an inherited IRA.

Your spouse can take over your IRA account and manage it as if it were their own, including the calculation of required minimum distributions. If you have a 401(k) or similar employer sponsored plan it must be rolled over into an inherited IRA.

Since non-spousal beneficiaries of inherited IRAs and 401(k)s or other employer sponsored retirement accounts cannot add inherited account balances to their own, they may have four options.

- Beneficiaries can opt for a lump-sum distribution. This can be split among beneficiaries if there are more than one.

- The withdrawal will not be subject to the usual 10% early withdrawal penalty that you would have paid.

- The money will be taxed that year based on the nature of the account. You will pay income tax for all withdrawals from traditional accounts or on earnings from Roth accounts, but not on the previously taxed contributions.

- Some 401(k) plans will allow these beneficiaries to leave the balance in the plan and take RMDs over their lifetime — this will likely change because of the SECURE Act‘s IRA time limits — or to leave the money in the plan for up to 5 years, during which they must either take distributions or roll the funds into an inherited IRA account.

- The assets continue to grow tax-deferred and can be withdrawn at any time.

- Withdrawals will be taxed that year based on the nature of the account, traditional or Roth.

- Rules for required minimum distributions are similar to those listed above.

- They can name their own beneficiaries for the new account.

- When this option is not available or if they prefer they can roll these accounts into an inherited IRA. Also known as a beneficiary IRA, it is an account specifically opened by any beneficiary, spouse, relative, or unrelated person or entity (estate or trust), to roll over any type of inherited retirement account.

- Rolling over the account avoids the assessment of income taxes when the money is transferred, although beneficiaries must file IRS forms 1099-R and 5498.

- Beneficiaries can opt to have the withdrawals spread out over time. The SECURE Act requires not designated beneficiaries, those who are not your spouse, chronically ill or disabled, less than 10 years older than you, or a minor child to withdraw the entire account by 10 years after inheriting.

- This option gives them flexibility within that time frame to withdraw the money whenever they need it.

- Unless it is a Roth account, this will spread the tax liability over a few years.

- This is probably their best option if a lifetime distribution is not an option.

- There may be a mandatory 20% withholding tax when the money is withdrawn.

- Minor children can spread the withdrawals over the number of years left until their age of maturity.

- Aside from some employer sponsored plans, other designated beneficiaries can spread the withdrawals out over their lifetime.

- Required minimum distributions will start based on your age at the time of death and whether or not you have already started getting them before then.

- Your beneficiary may or may not get notification as to the amount of the required distribution, so they will need to keep track of this to avoid the stiff penalties associated with not taking the required distribution.

- If you were younger than 73 when you died, the surviving spouse must start taking distributions by either the end of the year of your death or the end of the year in which you would have turned 72, whichever date is later.

- If you were older than 72 at the time of your death and not taking withdrawals, your surviving spouse must begin them by the end of the year following your death.

- If you were older than 72 at the time of your death and already taking withdrawals, your surviving spouse must begin them by the end of the year of your death.

- Every year the IRS Single Life Expectancy Table and remaining balance in the account is used to determine the required minimum distribution for that year, although they can withdraw more.

- This continues until there is nothing left in the account or their death, whichever is sooner.

- If a lifetime spread is not offered by your plan, request your employer do a trustee-to-trustee transfer to a retirement account that does.

- Required minimum distributions will start based on your age at the time of death and whether or not you have already started getting them before then.

- Inherited IRAs do not have the same protection from creditors as the original plans did.

- They could name a trust as the beneficiary. The trust can be set up in a way that allows you some control of how the funds are distributed after your death. You would do this for similar reasons as creating any testamentary trust, such as protecting your children from themselves or a step-parent, providing for a disabled child, or donating to a charity.

- The trust can either distribute the account to the beneficiaries (Conduit Trust) or accumulate the payouts and distribute the money to the beneficiaries over a longer period of time (Accumulation Trust).

- Disbursements to individuals from the trust follow the rules for inherited trusts.

- Disbursements to not designated beneficiaries, such as estates, charities, and trusts, are based on your age at the time of your death.

- If you died prior to age 73 the beneficiary must take out the remaining balance over the five-year period following your death.

- If you died after age 73 the beneficiary must take out the remaining balance over your remaining life expectancy.

Resources

- 401(k) Calculator. AARP website.

- Average Retirement Savings vs. Emergency Savings by Age Group. thebalance website.

- How to Split Retirement Plans During a Divorce. Investopedia website.

- Lieber R, St. John T. How to Win at Retirement Savings. The New York Times.

- Limits on contributions and benefits by account type. IRS website.

- List of situations where the early withdrawal tax from a retirement account can be waived. IRS website.

- Retirement Age Calculator. USA.gov.

- Royal J. How to save for retirement. Bankrate website.

- Segal T. 4 Reasons to Borrow From Your 401(k). Investopedia website

- SIMPLE IRA Plans for Small Businesses (PDF). IRS website.

- The SECURE Act

- Traditional IRAs. IRS website.

- Tretina K. How To Save For Retirement. Forbes website.

- 401(k) and 403(b) Plans: Knowing the Difference. Investopedia website. Updated: September 6, 2022. Accessed: February 15, 2023.

- 401(k) Plan Overview. IRS website. Updated: January 4, 2023. Accessed: February 15, 2023.

- Anspach D. Inherited 401(k): Options and Rules You Must Follow. thebalance website. Updated: October 21, 2021. Accessed: February 15, 2023.

- Anspach D. IRA Limits on Contributions and Income. thebalance website. Updated: August 25, 2022. Accessed:February 15, 2023.

- Anspach D. 10 Things You Need to Know About IRA Rollovers. thebalance website. Updated: June 25, 2022. Accessed: February 15, 2023.

- Anspach D. What Is an IRA? thebalance website. Updated: December 21, 2022. Accessed: February 15, 2023.

- Appleby D. SIMPLE 401(k) Plan. Investopedia website. Updated: February 7, 2023. Accessed: February 15, 2023.

- Appleby D. The Best Retirement Plans to Build Your Nest Egg. Investopedia website. Updated: December 5, 2022. Accessed: February 15, 2023.

- Axelton K. What’s the Difference Between SIMPLE IRA and SIMPLE 401(k) Plans? experian website. Updated: December 19, 2022. Accessed: February 15, 2023.

- Bloomenthal A. 401(k) vs. IRA Contribution Limits. Investopedia website. Updated: December 1, 2022. Accessed: February 15, 2023.

- Bloomenthal A. Saver’s Tax Credit: A Retirement Savings Incentive. Investopedia website. Updated: February 8, 2023. Accessed: February 15, 2023.

- Bieber C. How Nondeductible IRAs Work. The Motley Fool website. Updated: May 6, 2022 Accessed: February 15, 2023.

- Caldwell M. What Is a 403(b) Plan? thebalance website. Updated: December 6, 2022. Accessed: February 15, 2023.

- Cautero R. SIMPLE IRA vs. SIMPLE 401(k): What’s the Difference? smartasset website. Updated: December 28, 2022. Accessed: February 15, 2023.

- Choosing a Retirement Plan: SIMPLE 401(k) Plan. IRS website. Updated: January 24, 2023. Accessed: February 15, 2023.

- Choosing a Retirement Plan: SIMPLE IRA Plan. IRS website. Updated: December 21, 2022. Accessed: February 15, 2023.

- COLA Increases for Dollar Limitations on Benefits and Contributions. IRS website. Updated: October 24, 2022. Accessed: February 15, 2023.

- Cussen M. Benefits of a SIMPLE IRA. Investopedia website. Updated January 25, 2021. Accessed: November 25, 2021.

- Geler B. How Safe Harbor 401(k) Plans Work. smartasset website. Updated: February 3, 2023. Accessed: February 15, 2023.

- Hagan K. Choosing the Best Retirement Plans for You. The Motley Fool website. Updated: December 16, 2022. Accessed: February 15, 2023.

- Hagen K. Inherited 401(k)s: Your Complete Guide. The Motley Fool website. Updated: January 3, 2023. Accessed: February 15, 2023.

- Hagen K. The Basics of Inherited IRAs for Beneficiaries. The Motley Fool website. Updated: January 9, 2023. Accessed: February 15, 2023.

- Hagen K. Solo 401(k) Plans for the Self-Employed. The Motley Fool website. Updated: January 3, 2023. Accessed: February 15, 2023.

- Hartill R. What is a Roth IRA? How to Get Started. The Motley Fool website. Updated: January 9, 2023. Accessed: February 15, 2023.

- Hayes A. Traditional IRA. Investopedia website. Updated: December 28, 2022. Accessed: February 15, 2023.

- Inherited IRA and 401(k) Rules Explained. Investopedia website. Updated: April 12, 2022. Accessed: February 16, 2023.

- Josephson A. What Is a Non-Deductible IRA? smartasset website. Updated: February 2, 2023. Accessed: February 16, 2023.

- Josephson A. What Is a Profit-Sharing Plan? smartasset website. Posted: December 7, 2022. Accessed: February 16, 2023.

- Kagan J. Inherited IRA: Definition and Tax Rules for Spouses & Non-Spouses. Investopedia website. Updated: April 30, 2021. Accessed: February 16, 2023.

- Kagan J. SIMPLE IRA: Definition, How Small Businesses Use, and Drawbacks. Investopedia website. Updated: November 26, 2021. Accessed: February 16, 2023.

- Kagan J. Simplified Employee Pension (SEP): What It Is, How It Works. Investopedia website. Updated; January 29, 2023. Accessed: February 16, 2023.

- Kagan J. Thrift Savings Plan (TSP): How It Works and Investments. Investopedia website. Updated: December 8, 2022. Accessed: February 16, 2023.

- Kenton W. Profit-Sharing Plan: What It Is and How It Works, With Examples. Investopedia website. Updated: March 24, 2022. Accessed: February 16, 2023.

- Lake R. 401(k) Inheritance Tax Rules: Estate Planning. yahoo!finance website. Updated: November 17, 2021. Accessed: February 16, 2023.

- Liberto D. 457 Plan. Investopedia website. Updated: January 23, 2023. Accessed: February 16, 2023.

- Mercadante K. 403(b) vs. 401(k): A Deep Dive Into Their Similarities & Differences investorjunkie website. Updated: January 10, 2023. Accessed: February 16, 2023.

- McWhinney J. An Introduction to the Roth 401(k). Investopedia website. Updated: December 6, 2022. Accessed: February 16, 2023.

- Orem T, Ayoola E. What Is a Roth IRA? Basics To Know and How to Start One. nerdwallet website. Updated: February 8, 2023. Accessed: February 16, 2023.

- O’Shea A, Orem T. Traditional IRA Definition, Rules and Options. nerdwallet website. Updated: January 31, 2023. Accessed: February 16, 2023.

- Parker T. Which Is Better for Your Retirement: 403b vs 401k? thebalance website. Updated: December 17, 2022. Accessed: February 16, 2023.

- Perez W. How Taxes & Roth Individual Retirement Accounts Work. the balance website. Updated: November 15, 2021. Accessed: November 16, 2021.

- Perez W. Tax Planning with Simplified Employee Pension (SEP) Plans. the balance website. Updated: September 27, 2022. Accessed: February 16, 2023

- Perez W. Understanding Individual Retirement Accounts – IRAs. the balance website. Updated: December 6, 2022. Accessed: February 16, 2023.

- Phipps M. What Is a 457(b) Plan? the balance website. Updated: December 12, 2022. Accessed: February 16, 2023.

- Phipps M. What Is a Profit Sharing Plan? the balance website. Updated: May 31, 2022. Accessed: February 16, 2023.

- Phipps M. What Is a Safe Harbor 401(k)? the balance website. Updated: December 9, 2022. Accessed: February 16, 2023.

- Phipps M. What to Do With an Inherited IRA or 401(k). the balance website. Updated: December 13, 2022. Accessed: February 16, 2023.

- Pomroy K. What Is a SIMPLE 401(k) and How Does It Work? experian website. Updated: September 5, 2022. Accessed: February 16, 2023.

- Pritchard J. What an IRA Is for and How It Works. thebalance website. Updated: June 27, 2021. Accessed: November 15, 2021.

- Retirement Savings Contributions Credit (Saver’s Credit). IRS website. Updated: December 21, 2022. Accessed: February 16, 2023.

- Retirement Topics – 403(b) Contribution Limits. IRS website. Updated: November 7, 2022. Accessed: February 16, 2023.

- Retirement Topics – SIMPLE IRA Contribution Limits. IRS website. Updated: October 26, 2022. Accessed: February 16, 2023.

- Richmond S. Roth 401(k) vs. Roth IRA: What’s the Difference? Investopedia website. Updated: January 15, 2023. Accessed: February 16, 2023.

- Rollovers of Retirement Plan and IRA Distributions. IRS website. Updated: June 6, 2022. Accessed: February 16, 2023.

- Rosen R. Should You Contribute to a Non-Deductible IRA? Investopedia website. Updated: November 14, 2022. Accessed: February 16, 2023.

- Roth IRAs. IRS website. Updated: November 5, 2021. Accessed: November 16, 2021.

- Rubin M. A Guide to Nondeductible IRA Contributions. The balance website. April 21 2022. Accessed: February 16, 2023.

- Segal T. Roth IRA. Investopedia website. Updated: November 10, 2022. Accessed: February 16, 2023.

- SIMPLE IRA Contribution Limits. IRS website. Updated: October 26, 2022. Accessed: February 16, 2023.

- Simplified Employee Pension Plan (SEP). IRS website. Updated: December 21, 2023. Accessed: February 16, 2023.

- Simplified Employee Pension (SEP) IRA: What It Is, How It Works. Investopedia website. Updated: January 29, 2023. Accessed: February 16, 2023.

- Traditional and Roth IRAs. IRS website. Updated: October 26, 2022. Accessed: February 16, 2023.

- Van der Does K. What is a TSP (Thrift Savings Plan)? And What Does It Do? (Your How-To Guide). Federal Benefit Advisory website. Posted: October 7, 2021. Accessed: February 16, 2023.

- Waggoner J. How Much Can You Contribute to a 401(k) for Retirement in 2023 and 2024? AARP website. Updated: November 2, 2023. Accessed: November 6, 2023.

- Zinn D. A Guide to SIMPLE 401(k) Plans. smartasset website. Updated: January 6, 2023. Accessed: February 16, 2023.