Charitable Trusts

Updated: January 9, 2023

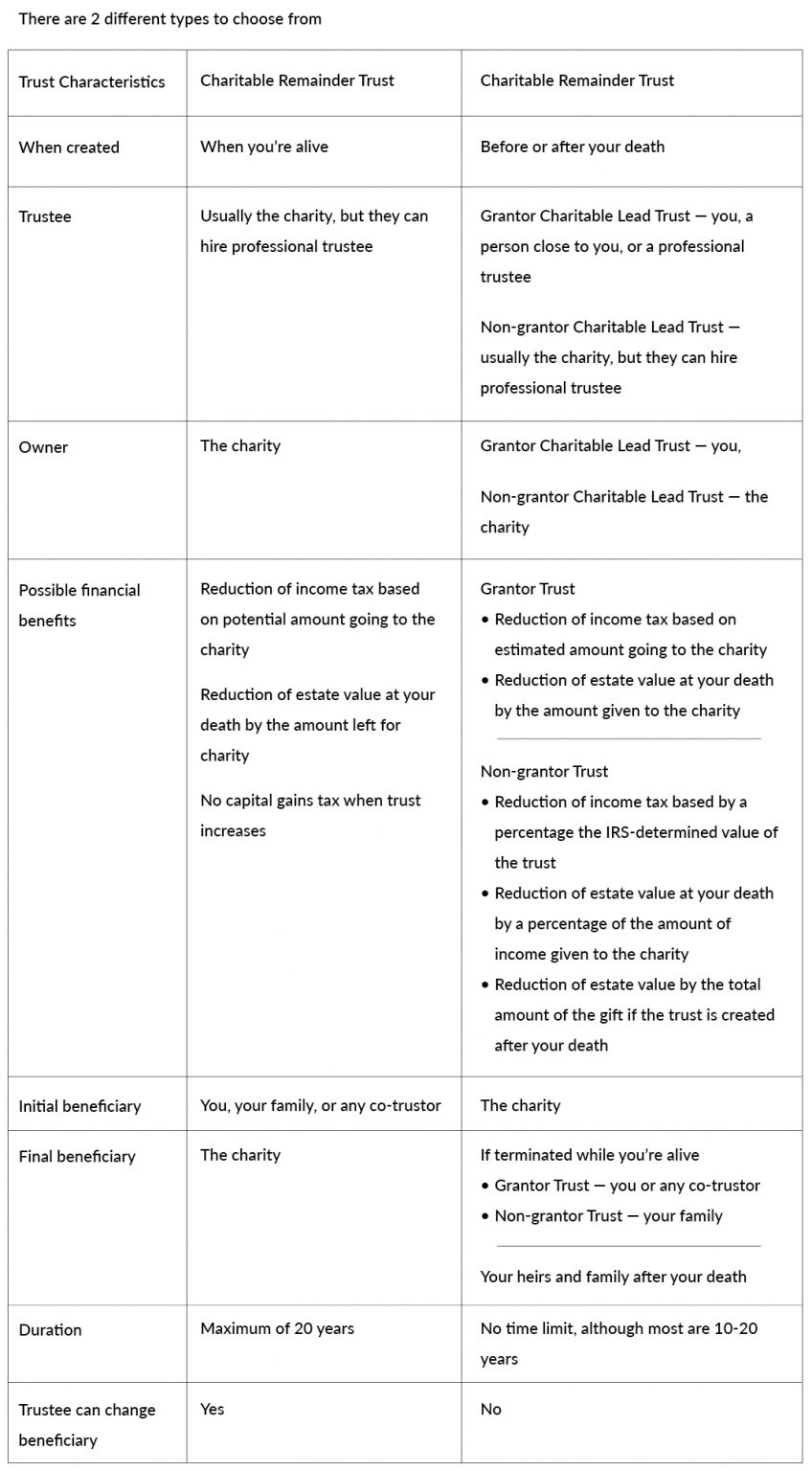

Giving to charity can feel rewarding and benefits good causes. For the most part, we give gifts while we are alive and receive benefits on our income taxes. Charitable gifts can also be used to reduce estate and capital gains taxes if you create a trust specifically for a charitable purpose. Assets put into these trusts may be used as income tax deductions or are removed from your estate to reduce estate taxes.

- Initial or final beneficiary; and

- The owner of the trust.

- This is an account specifically dedicated to supporting charitable organizations in general.

- A DAF is created by making tax deductible donations to a sponsoring organization, rather than a specific charity, that creates a fund that is used to invest your donated assets to various charities sponsored by the organization.

- You can donate the same assets as with a charitable trust and your donations are permanent.

- You can recommend gifts to specific charities from this fund.

- This usually means having tax-exempt status under the Internal Revenue Code.

- These are typically a 501(c)(3) or other tax-exempt organizations such as:

- Churches and religious organizations;

- Private foundations;

- Political organizations;

- Social welfare organizations;

- Civic leagues;

- Social clubs;

- Labor organizations;

- Business leagues;

- Universities;

- Research institutions;

- Arts group; and

- Hospital, human rights, or animal welfare organizations.

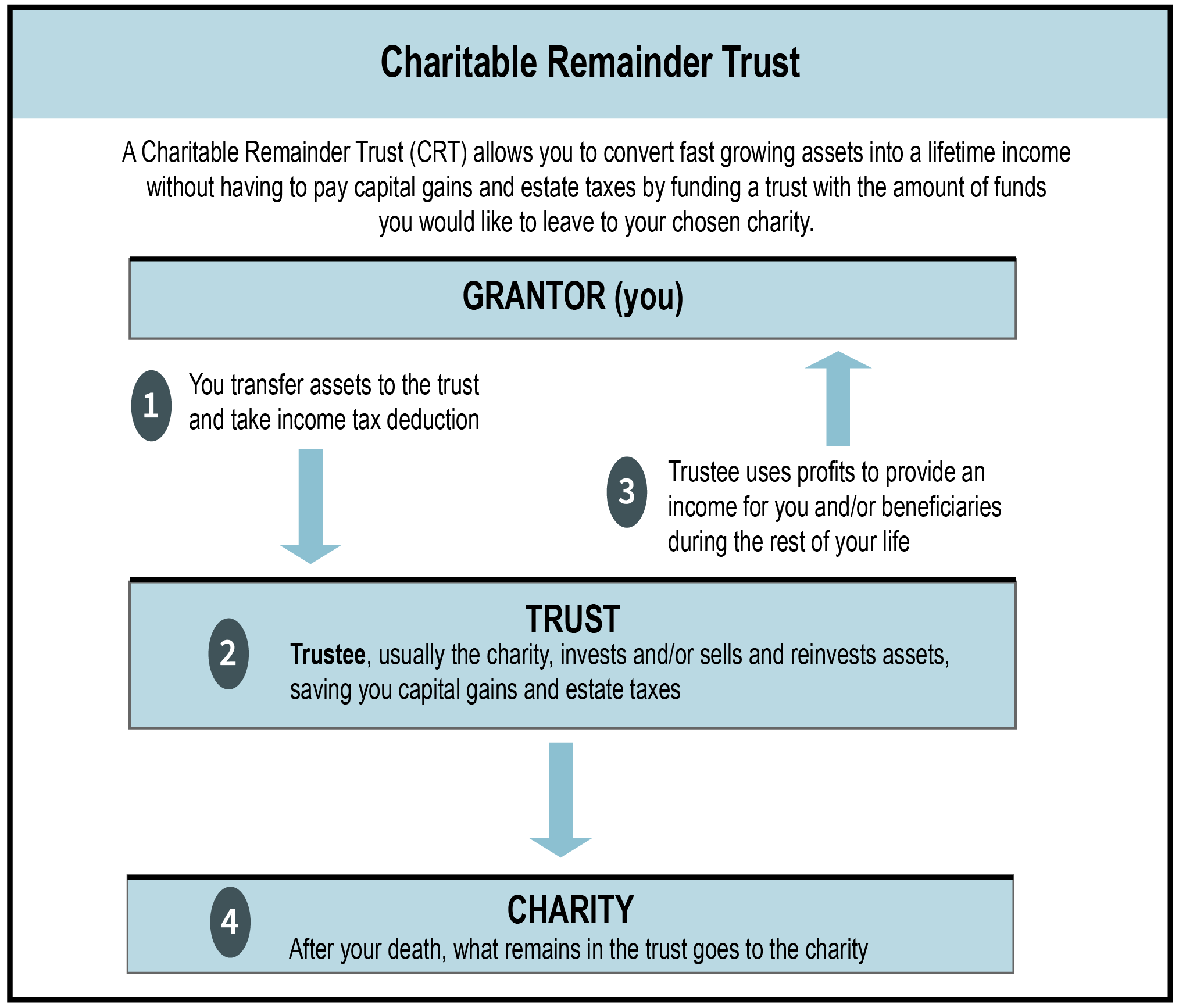

Charitable Remainder Trust

A Charitable Remainder Trust is the most common charitable trust and is established as part of an estate plan. It is an irrevocable living trust that is created while you are alive that provides income for you, your family, or other beneficiary. The charity will usually be the trustee and is the final beneficiary when the trust expires and gets the ‘remainder’ of the funds in the trust.

The trust is created and funded during your lifetime with the amount you would like to leave that charity after the trust ends.

- You can do this as a pooled income trust, where two or more people (grantor or trustor) fund the trust and receive income for a specified period of time.

- In addition to cash, they can be funded with publicly traded securities, some types of closely held stock (not S-Corp stock), real estate without a mortgage, business interests, certain other complex assets, and art or other valuable assets.

- The Secure 2.0 Act, part of the Consolidated Appropriations Act of 2023(the National Budget), which was signed into law by President Biden on December 29, 2022, allows a one-time donation (qualified charitable distribution) from an IRA to a charitable remainder trust of up to $50,000.

You can take an immediate charitable income tax deduction based on the trust’s assets that will eventually pass to charity and spread it over five years.

- You cannot simply deduct the value of the property. The amount of income you’re likely to get from the property/trust for the duration of the trust will be deducted by the IRS from the final gift.

- For example, if you put $100,000 into the trust and expect to get $25,000 in income back (based on your life expectancy, interest rates, and how the trust document is set up), you can only deduct $75,000 from your income tax base.

- However it’s more complicated.

- The deduction is based on the amount of income received, the type and value of the asset, the grantor’s age, and the Section 7520 rate, which fluctuates.

- The IRS will account for a certain rate of growth of trust assets based on interest rates.

Once the trust is funded it is irrevocable and the charity usually becomes the trustee as well as the beneficiary.

- You will be able to include instructions for the trust that the trustee must follow. However, any decision you make is difficult to change going forward.

- It is possible to name a different trustee who will be more open to your suggestions about the trust, usually a professional.

- The trustee may be able to change the ultimate beneficiary, unless specified in the trust.

- Charitable trusts usually contain provisions to allow modification of the trust agreement to comply with changes in federal tax or other laws.

The trustee protects and manages the trust, including investing the assets to increase its value.

- This may include interest, dividends, and rent income.

- Because the charity is the owner, no capital gains taxes are assessed if the trust gains in value.

Once formed, the trust is used to generate income for you, your family, or any co-trustor.

- While any income or appreciation generated by the trust is not taxed, payments to you or your family are subject to income tax.

- If you want to give more, the charity can receive income as long as at least one of the other recipients is not a charity.

There are three ways to determine the income that will be provided by the trust. The first two are similar to the grantor retained income trust.

There are three ways to determine the income that will be provided by the trust. The first two are similar to the grantor retained income trust.

- A Charitable Remainder Annuity Trust (CRAT)

The CRAT provides a fixed income/annuity each year despite the value and earnings of the trust or your changing needs.

- This is usually about 30%, but it may be between 20% to 50% of the current trust’s value.

- Although you can elect for payments as high as you want, there are limits.

- The higher the payments, the smaller the trust becomes, which lowers the amount of income tax deduction you can take.

- Payments that are too high reduce the value of the trust and ultimately deplete the trust before the payment term is over, especially since you can no longer contribute to the trust.

- This would leave nothing for the charity and make it unlikely they would accept any gift on those terms.

Although the trustee of the CRAT can buy and sell assets, you cannot add additional assets once it is formed.

- A Charitable Remainder Unitrust (CRUT)

The CRUT provides a yearly income based on a fixed annual percentage of the balance of the trust assets.

- The income will vary depending on the value of the CRUT each year.

- The IRS mandates that you must receive at least 5% but no more than 50% of the value of the trust yearly.

You can make additional contributions to a CRUT which will increase the value and income of the trust.

- With a Bare Trust the beneficiary keeps the rights to the capital and assets in the trust in addition to the income generated from these assets.

- While a trustee usually manages the trust investments, the beneficiary has the final say over how the trust’s capital or income is distributed.

- Beneficiaries are taxed on the income/earnings that trust generates.

You can use the trust to avoid capital gains tax on the sale of assets that have significantly increased in value, such as stock or real estate.

- Charities do not have to pay capital gains tax and you can take advantage of this.

- The charity trustee can sell any assets in the charitable trust that are no longer producing enough income free of capital gains tax and use the revenue to purchase assets or property that do.

- If you have property with significant gains that you want to sell, you can have the trustees buy it at the original price and then sell at the current value. The proceeds will stay in the trust and contribute to your income without you paying capital gains tax.

The remaining assets in the trust then go to the charity when it ends, either at your death or after a specified period of your choice, not to exceed 20 years.

- Because these assets are going directly to the charity, the amount will be removed from your estate value which may decrease estate taxes if you are over the limit.

- If you have children you want to leave assets to but don’t have enough resources to create a trust for them, you can put the income tax savings and part of the income you receive into an irrevocable life insurance trust. The trustee of the insurance trust can then buy enough life insurance to replace the full value of the asset for your them or other beneficiaries.

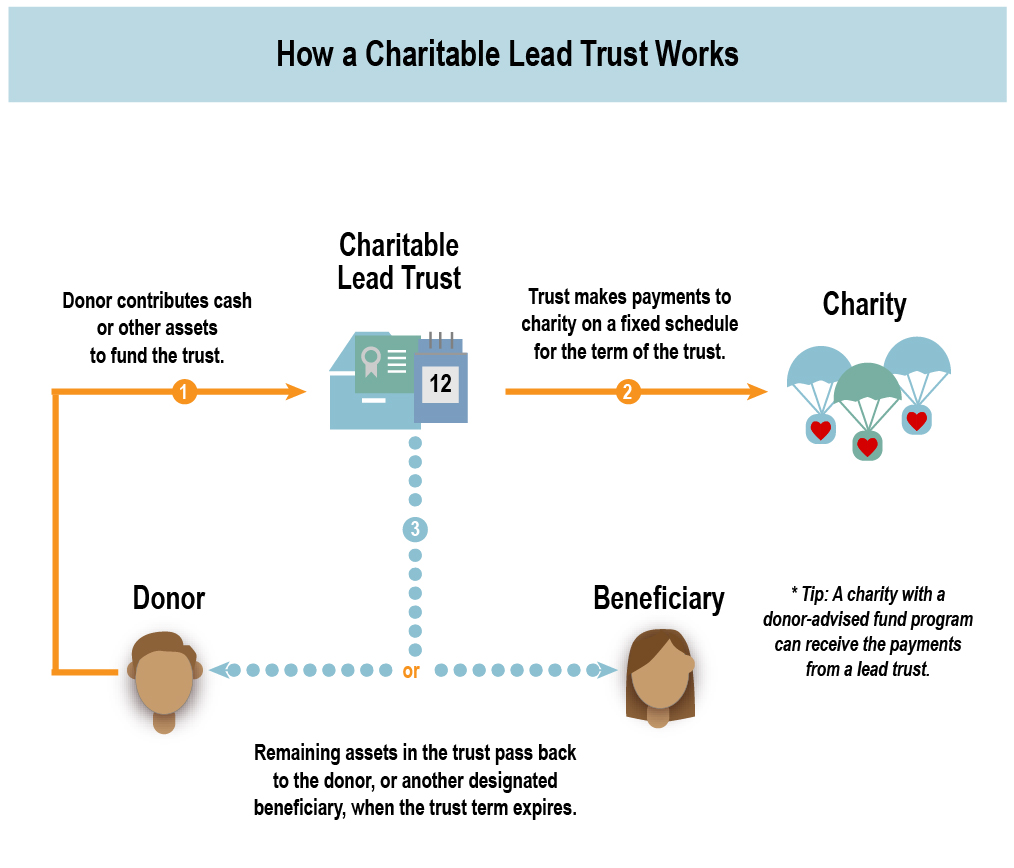

Charitable Lead Trust

A charitable lead trust can be a living trust created while you are alive or a testamentary trust created after your death. It is an irrevocable trust that provides income for your chosen charity for a certain amount of time. The charity ‘leads’ the way by being the first beneficiary, after which the assets go to you (living trust only) or a person or group of persons you name as beneficiary. Unlike a Charitable Remainder Trust, there is no limit to how long this trust can exist.

There are multiple options to consider when creating a Living Charitable Lead Trust, each may have different tax considerations.

- A grantor charitable lead trust where you are the owner or a non-grantor charitable lead trust where the charity is the owner.

- A reversionary trust where the assets remaining after the trust expires revert to you or a non-reversionary trust where they will be distributed to other beneficiaries not related to the charity.

A reversionary trust where the assets remaining after the trust expires revert to you or a non-reversionary where they will be distributed to other beneficiaries not related to the charity.

In addition to money, assets such as publicly traded stock, real estate, private business interests and private company stock could be contributed.

- These assets are more complicated when determining tax deductions and estimated revenues.

- If there is not enough cash available for income payments to the charity, these assets would likely be sold to generate the needed revenue.

The charity will be the first to benefit by receiving income for a predetermined time or when a specific event occurs, such as your, your spouse’s, or your children’s death.

There are no required minimum or maximum payments to the charity so as long as payments are made at least annually.

Income to the charity can be determined by one of two methods.

- An annuity-style trust provides a fixed income/annuity each year, despite the value and earnings of the trust or your changing needs. With this method it is possible to deplete the trust before it expires, resulting in no inheritance for the ultimate beneficiaries.

- A unitrust-style provides a yearly income based on a fixed annual percentage of the trust assets.

Depending on the type of lead trust, you or your beneficiaries may be entitled to some financial benefits while the charity is receiving income from the trust.

With a grantor charitable lead trust you are the owner, so any income that goes to the charity essentially comes from you.

With a grantor charitable lead trust you are the owner, so any income that goes to the charity essentially comes from you.

- This allows you to take an immediate income tax deduction for the estimated amount of income/gains the charity would receive over the duration of the trust.

- Any donation of cash would allow you to deduct up to 30% of your adjusted gross income (AGI) in any single year. Any unused deductions can usually be carried over into the subsequent five tax years.

- The deduction limit for appreciated securities or other assets is also generally limited to no more than 30 percent of AGI in the year of the donation.

- The IRS uses a process called a present value determination to make the estimate.

- This determination basically assumes that inflation will reduce the value or spending power of the dollar so that payments will be worth less as time goes on.

- They will first calculate the amount of money the charity will get based on the duration of the trust and either the annual annuity amount or the amount that might be generated by the specified percentage at a predicted interest/growth rate, also called the hurdle rate.

- The devaluation prediction based on this determination will be the amount allowed for the income tax deduction.

- Additional contributions to the trust are not included in the estimate and therefore are not deductible.

- Any income from the trust not going to the charity will be taxable as income and subject to capital gains tax.

- At your death, the amount of income that was given to the charity may be deducted from the estate.

- The IRS will determine how much of the trust is a charitable gift and what percentage of this amount is deductible from your income tax.

- The income tax deduction is based on the terms of the trust, the estimated payments to the charity over the term of the trust, an interest rate consistent with the expected rate of growth of trust assets, and the nature of the charity (public charity, a private foundation, political organizations, churches and religious organizations, or other nonprofits).

- The deducted amount does not count toward your lifetime gift tax exemption; the nondeductible amount does.

- A part of any additions/gifts to the trust while you are alive can be taken as a gift tax charitable deduction.

- Any income/earnings that goes to the charity does not come from you and can’t be deducted from your income taxes. This income would not be subject to capital gains.

- If the trust is non-reversionary and goes to your heirs after it expires, any income from the trust that was not given to the charity is considered a gift and subject to the gift tax.

- At your death, a percentage of the amount of income given to the charity may be deducted from the estate.

- When the trust is created after your death, the value of the trust is deducted from your estate and therefore will reduce estate taxes, if you are over the limit — $12,920,000 in 2023.

After this period, the remaining assets go to a beneficiary of your choice, although they cannot be affiliated with the charity.

- For example, you can direct annual payment to your favorite charity for 20 years, and then have your grandchildren receive the remainder when your child, their parent, dies.

- If the assets include IRA and 401(k), according to the SECURE Act of 2019 non-spousal IRA beneficiaries must withdraw all of the funds by the end of ten years following your death. See Inheriting Retirement Accounts.

- Charity. Fidelity Investment website. Accessed: January 9, 2023.

- Charitable Lead Trusts. Fidelity Charitable website. Accessed: January 9, 2023.

- Charitable Trust. FindLaw website. Updated: July 1, 2022. Accessed: January 9, 2023.

- Charitable Trusts. Internal Revenue Service (IRS) website. Updated November 22, 2022. Accessed: January 9, 2023.

- Charitable Remainder Trusts. Fidelity Charitable website. Accessed: January 9, 2023.

- Charitable Remainder Trusts. IRS website. Updated August 22, 2022. Accessed: January 9, 2023.

- Clifford D. The Charitable Remainder Trust: Do Good and Get Tax Breaks. NOLO website. Accessed: January 9, 2023.

- Kagan J. Charitable Lead Trust. Investopedia website. Updated: December 9, 2022. Accessed: January 9, 2023.

- Kagan J. Charitable Remainder Trust Definition: How It Works, and Types. Investopedia website. Updated: January 5, 2023. Accessed: January 9, 2023.

- Randolph M. Charitable Lead Trusts. NOLO website. Accessed: January 6, 2022.

- Silva D. How to Start a Charitable. Policygenius website. Updated: November 30, 2021. Accessed: January 9, 2023.

- Understanding Charitable Remainder Trusts. EstatePlanning website. Accessed: January 6, 2022.

- Wohlner R. What is a charitable trust? Bankrate website. Posted: September 13, 2022. Accessed: January 9, 2023.

- Wong B. Charitable Giving In Trusts. legalzoom website. Updated: November 16, 2022. Accessed: January 9, 2023.