Estates and Taxes

Updated: October 24, 2023

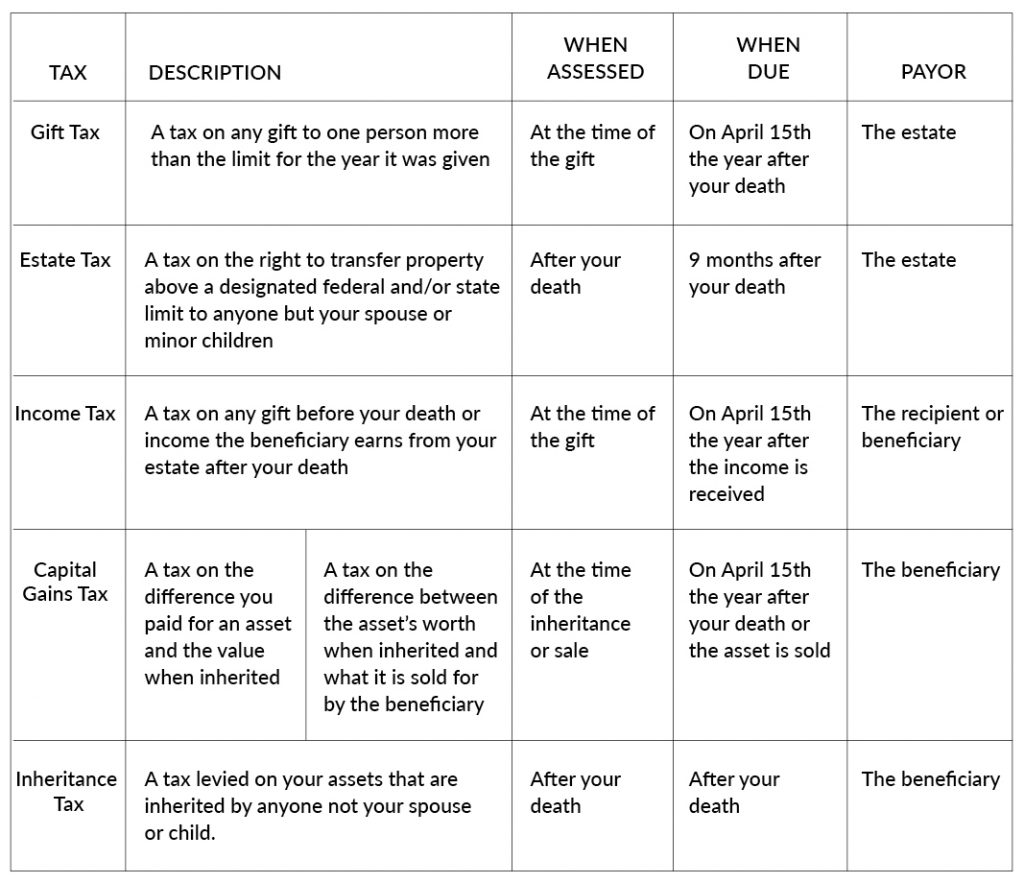

Like the end of life, taxes are also inevitable when your estate is passed on. There are five ways your estate may be taxed after you die, three of which will be paid by your beneficiaries and two by your estate.

The laws governing estate and gift taxes are quite complex, change frequently, and do not apply to all of your assets.

In 13 states you will be subject to both federal and state estate tax. There is variability from state to state in the estate value limit and which assets are taxable.

Other states have inheritance tax and one state (Maryland) has both. Your beneficiaries may also be subject to income taxes and capital gains taxes if they make a profit from your estate. Because of all this, you may require professional help to sort things out, especially if your estate is over the 2023 federal estate tax limit of $12,920,000 or in some cases your state’s estate tax limit, which can be as low as $1 million.

Like the end of life, taxes are also inevitable when your estate is passed on. There are five ways your estate may be taxed after you die, three of which will be paid by your beneficiaries and two by your estate.

Gift Tax

A gift is any voluntary transfer, either directly or indirectly, to another individual where the donor is not compensated for the full value of the transferred item. You must be competent to give the gift.

You can use gifts while you are alive to reduce your gross or taxable estate. In addition to money, gifts can include stocks, bonds, cars, or other assets. The amount of the gift is the monetary value or fair market value at the time of the transfer.

You will need to know about the federal allowances to avoid these gift taxes (Internal Revenue Code § 2503). This also applies in most states with their own estate taxes.

Gifts not given charitable donations cannot be deducted from federal income taxes.

There are factors that determine whether something is or is not a gift.

You make a gift if you:

- Give property (including money and stocks) or the use of or income from property without expecting to receive something of at least equal value to the fair market value on the date of transfer in return;

- Pay for or give money for someone else’s honeymoon, vacations, cars, etc.;

- Give someone money for tuition and/or medical bills — as opposed to paying the bills directly;

- Give an interest-free or reduced-interest loan to a family member or friend that they do not repay in full;

- Have a joint account with someone other than your spouse and allow them to take out money for their own use; and/or

- Add money to an adult child’s or other person’s trust. If it is an irrevocable trust it is considered a complete gift, if it is a revocable trust it is a partial gift.

You may be making a gift if you:

- Sell something at less than its full value; and/or

- Give an interest-free loan or a loan for an interest rate lower than the applicable federal rate; in this case the minimum interest rate that the Internal Revenue Service allows for private loans for the month it is given to a family member or friend even if they pay you back — 5.2% in December 2022.

It may not be considered a gift if you are paying legal obligations for children or other dependents or if you pay someone’s school directly for tuition or the hospital directly for medical bills.

It may not be considered a gift if you are paying legal obligations for children or other dependents or if you pay someone’s school directly for tuition or the hospital directly for medical bills.

Gifts to tax-exempt organizations are excluded. This could include:

- Certain nonprofit charities;

- Political organizations;

- A 501(c)(4) social welfare organization or civic league;

- A 501(c)(5) labor, agricultural, or horticultural organization; and/or

- A 501(c)(6) business association, such as a chamber of commerce.

Gifts with restrictions on the recipient, such as delayed use or access, are not eligible for annual exclusion and are fully taxable.

Giving away estate assets either before or after your death are considered gifts and can result in taxes for you or your beneficiaries. When you give something away to another person, other than your spouse (Internal Revenue Code § 2523), while you are alive you may be assessed gift taxes.

- Gift taxes are the only inheritance tax that will be assessed on your estate while you are alive.

- What’s confusing is that they are tied into the federal estate tax exemption and collectively known as the unified tax credit or unified credit.

- The tax is not paid by your estate until after you die.

- The tax rates are graduated for the amount over the limit your estate is and range from 18%-40%. Details can be found in the table Calculation of Federal Estate Tax in the Estate Tax section.

- Under special arrangements your beneficiary may agree to pay the tax instead. A tax professional can help you with this.

The gift tax law limits how much you can give an individual in a given year — $17,000 in 2023 ($34,000 for married couples if you both agree [Internal Revenue Code § 2513]) — before you need to file federal IRS Form 709 on the gifts, but does not determine whether or not you pay taxes on the gift. A special rule allows you to spread a one-time gift across five years’ worth of gift tax returns to preserve your lifetime gift exclusion.

- If you only give amounts allowed for each individual in a given year the government will not be aware of how much you are giving away. Since there is no limit on the number of individuals, it may be possible to give away much more than the estate tax threshold on the year of your death.

- If you exceed the limits the gift tax return must be filed by April 15th following the year in which the gift exceeding that year’s limit was given — Instructions for Form 709.

- The amounts of these excessive gifts accumulate over time and are deducted from the value of your estate the year of your death.

- You will only owe taxes on the gifts if the total lifetime gifts over the per individual per specific year limit exceed the limit on the total value of your estate for the year of your death, $12,060,000 in 2022 and $12,920,000 in 2023.

PER FAMILY MEMBER OR FRIEND PER YEAR LIMIT BY YEARS | ||||||

|---|---|---|---|---|---|---|

2004-2005 | 2006-2008 | 2009-2012 | 2013-2017 | 2018-2021 | 2022 | 2023 |

$11,000 | $12,000 | $13,000 | $14,000 | $15,000 | $16,000 | $17,000 |

For example, what happens if you give someone a gift in 2022.

- If you don’t exceed this limit, you can use these gifts to reduce the value of your estate and reduce federal estate taxes or eliminate it if you can get your estate value less than the federal estate tax limit for the year of your death. This can also be used to reduce your estate below your state’s estate tax limit.

- If you exceed the limit, it will reduce the value of your estate; but will also reduce the estate tax limit to below the one on the year of your death. For example;

- If you gave a $116,000 gift in 2022, it exceeds $16,000 the 2022 limit by $100,000;

- Therefore your estate will have to pay estate tax if your estate is over $12,820,000 ($12,920,000 minus $100,000 if you die in

2023.

2023.

These limits do not apply to gifts to spouses if they are not citizens of the USA. If your spouse is a noncitizen, the 2022 limit is $164,000 and the 2023 limit is $175,000 (Internal Revenue Code § 2523(i)).

The person receiving the gift usually does not need to report the gift, but the money needs to be included in their yearly tax return.

Your executor will use Form 709 to figure the generation-skipping tax imposed by the Internal Revenue Code — Instructions for Form 709.

Estate Tax

An estate tax is a tax on the right to transfer property above a designated federal limit to anyone but your spouse or minor children when you die. It is commonly referred to as a Death Tax. The amounts and rates listed apply to the year of your death, not the year the estate is finally settled.

All property left or gifted to your surviving spouse is inherited free of estate tax (I.R.C. § 2056(a)).

For federal tax purposes, the definition of a spouse includes any person lawfully married, including same-sex marriage (Obergefell v. Hodges).

The estate tax exemption limit will apply for property left or gifted to partners who are not eligible for the spousal exclusion, such as:

The estate tax exemption limit will apply for property left or gifted to partners who are not eligible for the spousal exclusion, such as:

- Noncitizen spouses; and

- Couples not considered spouses in their state — domestic partnerships, civil unions, or other similar formal relationships. You will need to check the laws in your state and any other state you own property in.

The 2023 federal limit is increased to $12.92 million, and will increase with inflation until December 2025, if the Tax Cuts and Jobs Act of 2017 remains in effect. After 2025 the act expires and the limit will revert to the 2017 limit, unless further legislation is passed.

Since less than 0.1% of all estates exceed this, most of the information about federal estate taxes only applies to wealthy families.

The value of your estate includes the amount in your will plus the value of any individual and/or family trusts.

You are only taxed on the amount over the limit. For example, if your taxable estate is $13 million in 2023, only $80,000 will be taxed.

The federal limit only applies to your gross estate, or taxable estate if you qualify for certain deductions.

If the estate has been held up in court for a while, the limit will be based on the year you died.

2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

12,920,000 | 12,060,000 | 11,700,000 | 11,580,000 | 11,400,000 | 11,180,000 | 5,490,000 | 5,450,000 | 5,430,000 | 5,340,000 |

States with their own estate tax have different limits, ranging from $1,000,000 to $11,400,000.

- This makes trusts useful for more people in these states, not just the 0.1%ers.

- This will be especially helpful in states that tax an entire estate if it exceeds the limit, not just the amount over the limit, like the federal tax.

Your Gross Estate is calculated based on an accounting of everything you own by yourself, are the trustee of, or have certain interests in at the time of your death.

- This property may include cash, savings, securities, real estate, insurance, trusts, annuities, business interests, vehicles, jewelry, collectables and other assets as found on IRS Form 706 (PDF).

- The worth of each asset is determined by the fair market value of these items, which may not be what you paid for them or what their values were when you inherited them (IRC §1014).

Your Taxable Estate is usually less than your gross estate due to deductions and allowed reductions in value.

Your Taxable Estate is usually less than your gross estate due to deductions and allowed reductions in value.

- You can deduct certain expenses and gifts such as mortgages and other debts, funeral expenses, estate administration, legal expenses, property that passes to surviving spouses, estate taxes paid to states, and gifts to qualified charities.

- Your estate may qualify for the reduction of the value of certain operating business interests or farms.

The estate tax is tied in with both the gift tax and generation-skipping tax.

While all estates are subject to federal estate tax, 13 states and the District of Columbia also have a state estate tax. All have lower estate tax thresholds than the federal government.

- Like the federal estate tax, these are paid from the estates assets.

- Most states use a graduated scale based on the amount the estate exceeds the limit to assess an estate’s tax liability.

- Many states increase the limit for inflation, while Connecticut will increase the limit rapidly until it equals the federal limit by 2023.

Estate Tax Limit and Rates by State

State | Tax Rates | |

12% | ||

11.2%-16% | ||

10%-15.7% | ||

0.8%-16% | ||

8%-12% | ||

0.8%-16% | ||

7.2%-16% | ||

13%-16% | ||

3.06%-16% | ||

10%-16% | ||

0.8%-16% | ||

16% | ||

10%-20% | ||

* Rate adjusted for inflation ** Any amount unused by your predeceased spouse can be added to the limit *** Rate adjusted for inflation and an additional $2.5 million can be added to the limit if your family-owned business is valued at less than $6 million. | ||

If you live in one of these states your state estate tax payments are subtracted from the value of your taxable estate before you calculate your federal estate taxes.

What Happens If I’m Over the Limit

There are a number of steps taken if your estate is over the limit.

- Your executor will need to file a federal estate tax return within nine months of your death. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

- Federal estate taxes will be calculated based on the amount your estate exceeds $12.92 million, not the total estate.

- If your estate has exceeded the gift limit during your lifetime, the excess amount will be added to the taxable amount which would have the same effect as lowering the estate tax limit by that amount.

The taxes will be paid with assets from your estate, not by your beneficiaries.

The estate assets are typically adjusted each year for inflation.

If your estate is over the limit, this table can give you a ballpark figure of the estate tax. Each Interval dollar amount of your estate up to $1 million dollars is taxed at a different rate, but the maximum is 40%.

Calculation of Federal Estate Tax

Tax Rate | Interval Amounts | Tax Owed |

18% | First $10,000 dollars over $12.92 million | 18% of taxable amount up to $10,000 |

20% | $10,001 – $20,000 | $1,800 plus 20% of $10,000 |

22% | $20,001 – $40,000 | $3,800 plus 22% of $20,000 |

24% | $40,001 – $60,000 | $8,200 plus 24% of $20,000 |

26% | $60,001 – $80,000 | $13,000 plus 26% of $20,000 |

28% | $80,001 – $100,000 | $18,000 plus 28% of $20,000 |

30% | $100,001 – $150,000 | $23,800 plus 30% of $50,000 |

32% | $150,001 – $250,000 | $38,800 plus 32% of $100,000 |

34% | $250,001 – $500,000 | $70,800 plus 34% of $50,000 |

37% | $500,001 – $750,000 | $155,800 plus 37% of $250,000 |

39% | $750,001 – $1,000,000 | $248,300 plus 39% of $250,000 |

40% | Over $1,000,0001 | $345,800 plus 40% of the amount over $1,000,000 |

Reducing Estate Tax

With knowledge about taxable and non-taxable assets there are ways to reduce your taxable estate, aside from leaving everything to your spouse. Some are more practical than others.

With knowledge about taxable and non-taxable assets there are ways to reduce your taxable estate, aside from leaving everything to your spouse. Some are more practical than others.

- Spend assets on vacations, entertainment, expensive dinners, and other intangible experiences. Be sure not to overspend before you pass on.

- Spread them around to your family or friends. See Gift Tax.

- Shield them in a trust or by a joint ownership with your spouse.

- Well crafted AB, credit shelter, or bypass trusts could provide a way to legally shelter some of your assets from federal estate tax.

- You will need to check the regulations in your state concerning what assets are protected from state and inheritance taxes.

- Estate taxes are portable, so can be used to increase the federal tax limit for your estate when your spouse dies and passes it on. To do this, your spouse will need to file IRS form 706 after your death.

- The exemption is based on the amount remaining from the limit the year you died.

- It will be added to the exemption limit for the year that they die.

- For example:

- If you died in 2016 when the limit was $5,450,000 and your estate was worth $3,000,000, you have $2,450,000 unused exemption; and

- If your spouse died in 2021, they could have passed on an estate of $14.15 (11.7 plus 2.45 million) before any estate tax will be collected.

- Other ways to get your estate under the limit without worrying about the gift tax include:

- Gifts to a political organization;

- Charitable gifts; and/or

- Moving to a more favorable tax environment. This is the least practical option, but if you are ready for a change, you can consider moving to the many states that don’t have an estate or inheritance tax.

Inheritance Tax

Only Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania collect inheritance tax. Maryland has both estate and inheritance taxes.

- As opposed to an estate tax, which is a tax on your estate for the right to bequeath your assets, an inheritance tax is paid by your beneficiaries for the right to inherit your assets.

- Your spouse is exempt from inheritance taxes as are certain close relatives in three of the five states that have them.

- Life insurance payments are considered inheritance, but are exempt if they go directly to your beneficiary.

Like the estate tax, the value of property and assets listed are “stepped-up” to the fair market value on the day of your death, not the year the estate is finally settled, and will be subject to capital gains tax.

Your beneficiaries pay inheritance tax based on the state you lived in, not the one they live in.

- They would be taxed if you lived in one of the five states with inheritance tax, even if they live in a different state that does not have them. The tax is paid to the state you lived in.

- The tax on liquid assets will probably be taken out of the inheritance by the executor, while inheritors may need to pay out-of-pocket for physical assets.

- They would not be taxed if you lived in one of the 45 states without inheritance tax, even if they live in a different state that has them. However, they would be taxed if the asset they received is located in their state.

Inheritance taxes can be assessed on property, mutual funds and stocks, annuities, retirement and investment accounts, etc. transferred via a will, intestate succession, trust, or a deed, depending on your state (and/or county) statutes.

Inheritance taxes can be assessed on property, mutual funds and stocks, annuities, retirement and investment accounts, etc. transferred via a will, intestate succession, trust, or a deed, depending on your state (and/or county) statutes.

- The rules vary by state and to complicate things further, there are specific tax rules based on the size of your estate, the type of asset or account, and the inheritor’s relationship to you. You will most likely need professional help.

- The IRS does not tax inheritance.

Spouses are not assessed inheritance taxes in any of these states. In addition:

- New Jersey exempts domestic partners;

- Maryland, and New Jersey exempt parents and children/grandchildren; and

- Kentucky exempts parents, children/grandchildren, siblings, and half-siblings.

Unlike Estate Tax, inheritance taxes are paid by the beneficiary.

Pennsylvania taxes all inheritance for non-exempt family and friends, while the other four have a threshold inheritance value below which no inheritance tax is collected.

- The limit depends on an heir’s relationship with you. The closer the relationship, the higher the limit.

- Only inheritance above the state limit is taxed.

The inheritance tax amount is a percentage of the total value of the inherited property, not just the amount over the threshold. The tax rates will also vary according to the beneficiary’s relationship to you.

- More distant relatives or heirs who aren’t related to you usually have the highest inheritance tax rates.

- In some states the tax rate increases with increasing gift amounts.

State | Threshold | Non-spousal Exemptions | Tax Rate Range | ||||

Descendants | Parents/Grandparents | Siblings | Others | ||||

Exempt*** | Exempt | No exemption | $500 | No exemption | ‘22 – 3%-9% ‘23 – 2%-6% | ||

Exempt | Exempt** | Exempt | $500-1,000 | No exemption | 4%-16% | ||

Exempt*** | Exempt | Exempt* | Exempt | No exemption | 10% | ||

‘$150,000 | $150,000 | ‘$150,000 | Exempt | ‘22- $40,000-60,000 ‘23- $43,500-62,500 | ‘22 – 1%-15% ‘23 – 0.75%-12% | ||

Exempt | Exempt | $25,000* | Exempt | $500 | |||

Exempt**** | $3,500 | No exemption | Exempt | No exemption | 4.5%-15% | ||

* Includes son-in-law and daughter-in-law. ** Excludes grandparents *** Includes step-children **** Children over 21 years old $3,500 | |||||||

Aside from spending your money while you are alive to reduce the inheritance, you can reduce the amount of inheritance tax by giving assets away while you are alive.

Income Tax

Unlike earned income, inheritance is not considered taxable income and does not need to be claimed on your state or federal income tax return. While the Inheritance itself is not taxed as income by the Internal Revenue Service, there are three circumstances where income tax will be due.

- Any taxable income that was not reported as income before your death must be reported as income by the beneficiary, whether an heir or the estate.

- These assets include employee compensation, bonuses, partnership income, interest, dividends, gain on sale of property occurring prior to death when funds are paid after death, crops, livestock, installment obligations, and royalties.

- Although your beneficiary pays the income tax, the funds essentially come from the estate. The payment can be looked at as money that would not have been there if you had reported it.

Any estate account created after your death that earns interest before the estate is settled will be taxed as income. The money comes directly from the estate, not the beneficiary.

Any estate account created after your death that earns interest before the estate is settled will be taxed as income. The money comes directly from the estate, not the beneficiary.- Any income from inherited assets can be taxed.

- Retirement accounts such as non-Roth 401(k)s and IRAs are taxed when your beneficiary withdraws from the accounts. Any income or interest generated from property or assets is usually taxable after your beneficiary takes possession of them, such as stocks, bonds, or annuities and tangible assets like cars, boats, and real estate.

- When any asset is sold the income is taxed as a capital gain.

- Assets are “stepped-up” to the current market value when inherited, so the income is the selling price minus the market value at the time of your death.

- Assets sold within the first year after it is inherited are taxed according to the seller’s tax bracket as outlined below. This is the case at the state level as well.

- Assets sold after the first year are taxed at the Long Term Capital Gains Tax Rates outlined in the Capital Gains Tax section.

Tax Rate | Income | |||

Single Filer | Married Filing Jointly | Married Filing Separately | Head of Household | |

10% | Up to $10,275 | Up to $20,500 | Up to $10,275 | Up to $14,650 |

12% | $10,276 – $41,775 | $20,551 – $83,550 | $10,276 – $41,775 | $14,651 – $55,900 |

22% | $41.776 – $89,075 | $83,551 – $178,150 | $41.776 – $89,075 | $55,901 – $89,050 |

24% | $89,076 – $170,050 | $178,151 – $340,100 | $89,076 – $170,050 | $89,051 – $170,050 |

32% | $170,051 – $215,950 | $340,101 – $431,900 | $170,051 – $215,950 | $170,051 – $215,950 |

35% | $215,951 – $539,900 | $431,901 – $647,850 | $215,951 – $323,925 | $215,951 – $539,900 |

37% | More than $539,900 | More than $647,850 | More than $323,925 | More than $539,900 |

Tax Rate | Income | |||

Single Filer | Married Filing Jointly | Married Filing Separately | Head of Household | |

10% | Up to $11,000 | Up to $22,000 | Up to $11,000 | Up to $15,700 |

12% | $11,001 – $44,725 | $22,001 – $89,450 | $11,001 – $44,725 | $15,701 to $59,850 |

22% | $44,726 – $95,375 | $89,451 – $190,750 | $44,726 to $95,375 | $59,851 to $95,350 |

24% | $95,376 – $182,100 | $190,751 – $364,200 | $95,376 to $182,100 | $95,351 to $182,100 |

32% | $182,101 – $231,250 | $364,201 – $462,500 | $182,101 to $231,250 | $182,101 to $231,250 |

35% | $231,251 – $578,125 | $462,501 – $693,750 | $231,251 to $346,875 | $231,251 to $578,100 |

37% | More than $578,125 | More than $693,750 | More than $346,875 | More than $578,100 |

The overall tax is determined by consecutively adding the amount calculated from each box or bracket until you reach the one that your income is in. Using the 2023 single filer amounts as an example let’s calculate the amount of income tax you owe if you earned $750,000 in 2022.

Taxable Income Tax Bracket | Tax Rate for the Bracket | Tax Calculation |

Up to $11,000 | 10% | 0.1 times $11,000 ($1,100) |

$11,001 – $44,725. | 12% | $1,100 plus 0.12 times the amount between $11,001 – $44,725 ($4,047) |

$44,726 – $95,375 | 22% | $5,147 plus 0.22 times the amount between $44,726 – $95,375 (11,143) |

$95,376 – $182,100. | 24% | $16,290 plus 0.24 times the amount between $95,376 to $182,100 ($20,814) |

$182,101 – $231,250 | 32% | $37,104 plus 0.32 times the amount between $182,101 – $231,250 ($15,728) |

$231,251 – $578,125 | 35% | $52,832 plus 0.34 times the amount between $231,251 – $578,125 ($121,406) |

Over $578,126 | 37% | $174,238.25 plus 0.37 times $750,000 minus $578,126 ($63,593) |

Total Income Tax Owed = $237,831 ($174,238.25 plus $63,593) | ||

Capital Gains Tax

An important difference for inherited assets is that they are “stepped-up,” meaning that the value of the inherited assets, such as property, stocks, or bonds, is re-adjusted to its current market value, not the value when initially purchased. This will usually reduce or entirely eliminate the capital gains tax owed by the beneficiary. Capital gains tax would still be owed if the basis was stepped-down and the asset is sold at more than the fair market value. The Biden Administration has proposed eliminating this benefit, but no action has yet been taken.

While capital gains taxes are not assessed when your beneficiaries inherit assets, they may be when they sell assets they have received. Only the capital gain amount is taxed, not the total value of the asset.

States may have their own capital gains tax regulations.

An important difference for inherited assets is that they are “stepped-up,” meaning that the value of the inherited assets, such as property, stocks, or bonds, is re-adjusted to its current market value, not the value when initially purchased. This will usually reduce or entirely eliminate the capital gains tax owed by the beneficiary. Capital gains tax would still be owed if the basis was stepped-down and the asset is sold at more than the fair market value. The Biden Administration has proposed eliminating this benefit, but no action has yet been taken.

While capital gains taxes are not assessed when your beneficiaries inherit assets, they may be when they sell assets they have received. Only the capital gain amount is taxed, not the total value of the asset.

States may have their own capital gains tax regulations.

- Capital assets can include property such as your home and vehicles, common stocks and bonds, mutual funds, and collectables. Capital gains taxes vary by asset.

- When selling a home, the first $250,000 ($500,000 for married couples) of the capital gain is free from taxes if the property was your primary residence and you have lived in it for at least 2 out of the last five years. Depreciations of property can also result in a tax reduction.

- Collectibles such as jewelry, art, antiques, precious metals, coins or stamps, are taxed at 28%.

- Some portions of business inventory are taxed at up to 28%.

- Capital gains rules are slightly different for mutual funds — capital gains distributions can be taxed even if they are reinvested.

- Those with a modified adjusted gross income of $200,000 or more ($250,000 if married filing jointly or qualifying surviving spouse with dependent child, $125,000 if married filing separately) will be assessed an additional 3.8% called a net investment income tax.

- Not all assets are subject to capital gains, such as other portions of business inventory and non-physical items such as copyrights, patents, inventions, designs, formulas, and compositions.

Basis for Capital Gains at the Time of Inheritance

- In most cases this will be a major benefit since the basis of most assets will be higher, i.e. worth more than when acquired.

- If the asset is a joint tenancy property, only the deceased co-owners basis is stepped-up; the surviving owners half of the asset is not.

- If you have an estate worth more than the estate tax limit, there may be an option to set the basis to the value six months after it is inherited. To do this you must make an election on IRS Form 706 within one year of the due date of the federal estate tax return.

- This is a disadvantage if the basis is less than the purchase price (stepped-down) since your beneficiaries inheritance would be less.

- Because they are stepped up, there is no adjusted basis allowed for inherited assets — such as adjustments for money spent on improvements, costs of sale, and/or any tax deductions previously taken for the property.

Capital Gains Tax After Sale of the Asset

When capital gain happen the capital gains taxes will be due when your beneficiary sells their inherited assets above the fair market value at the time it was inherited.  Capital loss happens if the opposite is true. No taxes are due and, except for personal property, they can deduct the loss from their total capital gains — called net capital gain — when calculating their income tax. However, there is a $3,000 maximum per year on these losses. Leftover losses can be carried forward to the following tax years.

Capital loss happens if the opposite is true. No taxes are due and, except for personal property, they can deduct the loss from their total capital gains — called net capital gain — when calculating their income tax. However, there is a $3,000 maximum per year on these losses. Leftover losses can be carried forward to the following tax years.

The capital gain or loss should be recorded on your beneficiaries income tax return for the year the inherited asset was sold. Net capital gains can be figured out using Schedule D of IRS Form 1040. The results can be entered on the tax return Form 1040 to figure your overall tax rate.

Assets sold after being inherited following your death can generate either a long-term or short-term capital gain, depending on when the property is sold.

A short-term capital gain applies to the sale of an asset owned for up to one year.

- If sold immediately at the fair market value, which would be the same as the basis, there would be no capital gains or tax.

- If sold immediately for more than the fair market value, which would be more than the basis, a capital gains tax would be assessed on the amount over that value.

- The basis remains the same, even if the fair market value changes over time, and a capital gains tax is due if the selling price is above the basis.

- Short-term capital gains are taxed as though they were income at your beneficiaries income tax rate, i.e. their tax bracket.

A long-term capital gain is the profit from the sale of an asset held for more than a year.

- Gains from the sale of inherited stock are an exception; they are classified as long-term capital gains even if they are sold shortly after inheriting them.

- Long-term tax rates are generally lower than short-term capital gains tax rates and are based on income and filing status.

| 2022 Long Term Capital Gains Tax Rates | ||||

| Income | ||||

| Tax Rate | Single Filer | Married Filing Jointly | Married Filing Separately | Head of Household |

| 0% | Up to $41,675 | Up to $83,350 | Up to $41,675 | Up to $55,800 |

| 15% | $41,676 – $459,750 | $83,351 – $517,200 | $41,676 – $258,600 | $55,801 – $488,500 |

| 20% | More than $459,750 | More than $517,200 | More than $258,600 | More than $488,500 |

2023 Long Term Capital Gains Tax Rates | ||||

Income | ||||

Tax Rate | Single Filer | Married Filing Jointly | Married Filing Separately | Head of Household |

0% | Up to $44,625 | Up to $89,250 | Up to $44,625 | Up to $59,750 |

15% | $44,626 – $492,300 | $89,251 – $553,850 | $44,626 – $276,900 | $59,751 – $523,050 |

20% | More than $492,300 | More than $553,850 | More than $276,900 | More than $523,050 |

You can use IRS forms to record sales that resulted in capital gains or losses and to calculate capital gains taxes.

- Use IRS Form 8949 to record each sale, and calculate your hold time, basis, and gain or loss.

- Figure your net capital gains using Schedule D of IRS Form 1040.

- Copy the results to your tax return on Form 1040 to figure your overall tax rate.

Generation-skipping Tax

The generation-skipping tax (GST), also called the generation-skipping transfer tax, is an estate tax. It applies to the transfer of assets either through a will or trust directly to a beneficiary, other than your spouse, that is 37 ½ years or more younger than you. This includes other family members and unrelated individuals.

It was created as a way to prevent you from avoiding estate tax by leaving some or all your assets directly to your grandchildren.

- The GST tax will be assessed when you transfer money or property directly to your grandchildren without first leaving it to their parents. Like the estate tax, gifts of $17,000 per person per year are exempt.

- It does not apply to transfers that have already been taxed when left to a previous generation, such as your grandchildren if their parents died before them (IRC Section 2651(e)). This is because your grandchildren effectively move up into their parents’ position and the gift is no longer skipping a generation.

- Your executor will use Form 709 to figure the generation-skipping tax imposed by the Internal Revenue Code — Instructions for Form 709.

Skipping or bypassing your children’s generation avoids your inheritance being subject to estate taxes when it moves from you to your children and then again from your children to your grandchildren.

The federal generation-skipping transfer tax will be assessed if the available inheritance is over your unused 2023 $12,920,000 tax exemption.

- For example, if you have already transferred $10,000,000 of your estate, the remaining federal generation-skipping transfer tax credit would be $2,920,000.

- The transfer tax would only be levied on any amount over this.

Unlike the estate tax, which is a graduated taxation rate from 18% to 40%, depending on the amount over the limit, the generation-skipping tax is 40% of the entire amount.

In this example, if you left your grandchild an additional $5,000,000, the estate would be over the tax credit by $2,080,000 ($15,000.000 minus $12,920,000) and the transfer tax would be $832,000 ($2,080,000 times 0.4).

You may be able to reduce gift, estate, and generation-skipping taxes by creating a Dynasty Trust.

Resources

- 2022 Capital Gains Calculator. NerdWallet website.

- Capital Gains Calculator 2022 – 2023. Zrivo website.

- Garber J. How to Calculate Your Estate Tax Liability.

- State Death Tax Chart. The American College of Trust and Estate Counsel website

- Tax information and forms from the IRS website.

- About Publication 559, Survivors, Executors and Administrators – Shows your representatives how to complete and file federal income tax returns and explains their responsibility to pay any taxes due on your behalf.

- Estate and Gift Taxes.

- Filing Estate and Gift Tax Returns. IRS website.

- Forms and Publications – Estate and Gift Tax.

- Frequently Asked Questions on Estate Taxes.

- Frequently Asked Questions on Gift Taxes.

- What’s New – Estate and Gift Tax

- Anspach D. Avoid These Inheritance Money Tax Traps. thebalance website. Updated: December 12, 2021. Accessed: December 5, 2022.

- Ashford K, Curry B. 2022 And 2023 Capital Gains Tax Rates. Forbes Advisor website. Updated: November 15, 2022. Accessed: December 5, 2022.

- Bell K, Orem T. Estate Tax: Definition, Tax Rates and Who Pays in 2022 and 2023. NerdWallet website. Updated: October 24, 2022. Accessed: December 5, 2022.

- Berry-Johnson J. Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It? Investopedia website. Updated: October 24, 2022. Accessed: December 5, 2022.

- Block S, Mengle R, Niedt B. 18 States With Scary Death Taxes, Kiplinger website. Updated: October 27, 2022. Accessed: December 5, 2022.

- Do You Pay Capital Gains Taxes on Property You Inherit? ElderLaw website. Updated: October 28, 2020. Accessed: December 6, 2022.

- Durant A. 2023 Tax Brackets. Tax Foundation website: Updated: October 18, 2022. Accessed: December 7, 2022.

- Estate Tax. IRS website. Updated: October 26, 2022. Accessed: December 6, 2022.

- Fernando J. Capital Gains Tax. Investopedia website. Updated: July 30, 2022. Accessed: December 6, 2022.

- Frequently Asked Questions on Gift Taxes. IRS website. Updated: October 27, 2022. Accessed: December 6, 2022.

- Frequently Asked Questions on Gift Taxes for Nonresidents not Citizens of the United States. IRS website. Updated: October 27, 2022. Accessed: December 6, 2022.

- Garber J. How Taxes Can Affect Your Inheritance. The balance website. Updated: November 13, 2022. Accessed: December 6, 2022.

- Garber J. How the Generation-Skipping Transfer Tax Exemption Works. The balance website. Updated: March 26, 2022. Accessed: December 6, 2022.

- Garber J. How the Federal Estate Tax Exemption Changed From 1997 to Today. The balance website. Updated: November 15, 2022. Accessed: December 6, 2022.

- Garber J. Learn About the Taxes Due After Someone’s Death. The balance website. Updated: June 15,2022. Accessed: December 6, 2022.

- Garber J. State Level Estate Taxes and Exemptions. The balance website. Updated: November 27, 2021. Accessed: December 6, 2021.

- Garber J. States Without an Estate Tax or an Inheritance Tax. The balance website. Updated: November 21, 2022. Accessed: December 6, 2022.

- Garber J. Understanding Death, Estate, and Inheritance Taxes. The balance website. Updated: January 15, 2022. Accessed: December 6, 2022.

- Garber J. What Is an Inheritance Tax? The balance website. Updated: July 18, 2022. Accessed: December 6, 2022.

- Garber J. Will You Have To Pay State Taxes on Your Inheritance? The balance website. Updated: November 22, 2022. Accessed: December 6, 2022.

- Gift Tax. IRS website. Updated: April 2, 2021. Accessed: December 3, 2021.

- Gifts & Inheritances. IRS website. Updated: September 2, 2022. Accessed: December 6, 2022.

- Gobler E. Gift Tax: How Much Is It and Who Pays It? The balance website. Updated: December 7, 2022. Accessed: December 7, 2022.

- Kagan J. Capital Gains Tax. Investopedia website. Updated: July 30, 2022. Accessed: December 6, 2022.

- Kagan J. Estate Tax. Investopedia website. Updated: May 7, 2022. Accessed: December 6, 2022.

- Kagan J. Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free. Investopedia website. Updated: October 30, 2022. Accessed: December 7, 2022.

- Kagan J. What is Inheritance Tax? Investopedia website. Updated: December 6, 2022. Accessed: December 7, 2022.

- Kennon J.. What Is a Step-Up in Basis?. The balance website. Updated: October 4, 2021. Accessed: December 7, 2022.

- Orem T. 2022-2023 Federal Income Tax Brackets & Tax Rates. NerdWallet website. Updated: October 20, 2922. Accessed: December 7, 2022

- Orem T, Davis C. Inheritance Tax: What It Is and How to Avoid It. NerdWallet website. Updated: October 28, 2022. Accessed: December 7, 2022.

- Orem T, Parys S. 2022-2023 Capital Gains Tax Rates and Calculator. NerdWallet website. Updated: October 20, 2022. Accessed: December 7, 2022.

- Orem T, Parys S. Gift Tax: How It Works, Exemptions and Rates. NerdWallet website. Updated: October 24, 2022. Accessed: December 7, 2022. Accessed: November 17, 2020.

- Reynolds P. Estate Taxes: Who Pays? And How Much? Investopedia website. Updated: January 9, 2022. Accessed: December 7, 2022.

- Ross M. What Are Gift Taxes? Investopedia website. Updated: November 13, 2022. Accessed: December 7, 2022.

- Segal T. Generation-Skipping Transfer Tax (GSTT). Investopedia website. Updated: May 24, 2022. Accessed: December 7, 2022.

- Silva D. Your guide to the gift tax. Policygenius website. Updated: December 1, 2021. Accessed: December 7, 2022.

- Waggoner J. 17 States With Estate or Inheritance Taxes. AARP website. Updated: March 9, 2022. Accessed: December 7, 2022.

- Waggoner J. Your 2023 Tax Brackets vs. 2022 Tax Brackets.. AARP website. Updated: October 19, 2022. Accessed: December 1, 2022.

- Weltman B. Capital Gains Tax 101. Investopedia website. Updated: December 6, 2022. Accessed: December 7, 2022.

- What Is an Inheritance Tax and Do I Have to Pay It? Ramsey website. November 10, 2022. Accessed: December 7, 2022.

- What Is the Generation-Skipping Transfer Tax? ElderLawNet website. Updated: January 13, 2022. Accessed: December 7, 2022.

- York E. 2022 Tax Brackets. Tax Foundation website: Updated: November 10, 2021. Accessed: December 6, 2021.